With easy to use mobile apps, zero-fee brokerages, and investment opportunities aplenty after the coronavirus stock market crash, there has been a swell of traders and investors. While many have made their riches from the market volatility, some have lost more than just their money. What should first-time retail investors be wary of and how can they get started safely?

Record high trading

The pandemic devastated the global economy, leaving many unemployed while lockdowns trapped them in their homes. With spare time on their hands, more are looking for alternate revenue streams. As the stock market faced a record fast crash in March, the low buy-in costs have attracted traders and investors in search of huge returns in the ensuing rebound.

Lured in by zero-fee commissions, new traders have flocked to online brokerages like Robinhood. In the first quarter of 2020, the app saw an influx of 3 million new accounts.

This pattern has mirrored in Singapore, where the Singapore Exchange (SGX) faced a surge in Central Depository (CDP) account openings. According to the Straits Times, from February to July, the number of CDP account openings was more than 2.5 times that in the same period last year.

Benefiting from the higher market activity, DBS Brokerage commissions rose by 25% in the first half of the year compared to 2019. Meanwhile, trading volumes at Standard Chartered Bank increased threefold.

Starting out young

The new generation of investors are also starting at a younger age. Nigel Ng, 21, an independent investor who shares his investment knowledge through his online alias, investwithnigel, said, “In the past, account opening was much more tedious, not to mention the really high commission costs. But now, such procedures are greatly simplified, and cost has also come down quite a bit. Especially for the younger crowd who tend to have smaller capital, this removes a big barrier.”

But this simplicity is a double-edged sword. As the lower barrier to entry attracts younger users, novice traders must be wary of the risks they are taking on before diving headfirst into the markets.

Yvonne Yuen, centre head and psychotherapist at WE CARE said, “Most of our clients who gamble in financial markets tend to be younger, typically in their 20s to their 40s. They also tend to be professionals, are tech-savvy, and usually higher-educated.”

The heavy risk

Not being knowledgeable of the financial instruments that you are trading with can sometimes cost you more than your capital. In June, a 20-year-old American student, Alexander Kearns, committed suicide after seeing a negative balance of over USD$730,000 while trading options on the Robinhood app. This was just a temporary balance before his assigned options were settled into his account. Unfortunately, Kearns was not aware of that.

“How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?” wrote Kearns in his final note. “I also have no clue what I was doing now in hindsight.”

Investing or gambling?

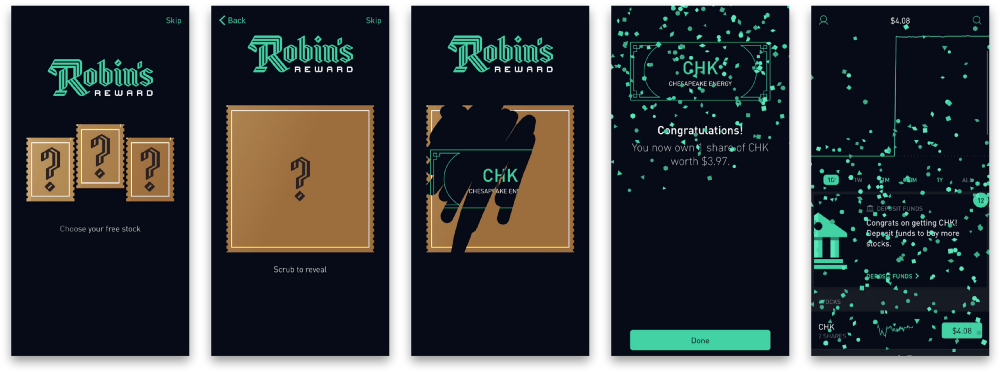

Robinhood is under fire with a class action suit against it for luring inexperienced traders with its “game-like interface”. However, trading is no game and has real-world consequences that can wipe out your savings and load you with considerable debt. Trading or investing without a strategy treads a thin line between speculating and gambling.

Said Yvonne: “If you recognise that you are constantly monitoring the market, hoping to recoup losses, or praying for a windfall to salvage your debts, you may be at risk of developing a problem in stock market speculation. It is recommended that you reach out for help, either to the National Council for Problem Gambling (NCPG) or to WE CARE.”

Getting schooled

While brokerages have a responsibility to ensure accurate and timely information is easily accessible, we are responsible for trading within our means. We need to be aware of our appetite for risk and have a deep understanding of each trading instrument that we adopt.

When starting on your investment education you may come across exorbitant courses and seminars — promising you trade secrets that guarantee huge returns within a short timeframe with little to no risk. Just loading a YouTube advertisement reveals yet another ‘expert’ who will share with you the insider secrets on how to make extreme wealth ‘with little to no money down’.

“The key mistake most first-time traders/investors make is wanting to make huge amounts of money in the shortest possible time,” said Nigel. “No thanks to tons of ads and ‘gurus’ these days that promise ‘quick riches’. That just doesn’t exist in the real world. Investing/trading can definitely make you money, but like any skills out there, it takes time to learn and master.”

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.