As Singapore eases its Covid-19 restrictions, and moving towards opening the economy, the construction industry is also bursting to start working again after two years of forced hiatus.

Labour restrictions due to restricted movement within the island republic, and the halting of imports of essential foreign labour have forced many construction firms to either reduce their operations or fold completely.

Now that Singapore is moving steadily towards normalcy, construction firms are aiming to revive their sleeping projects immediately, and quickly move on to new ones.

But a combination of factors continues to threaten the hard-won recovery of the sector.

On 18 February this year, The Edge Singapore reported that record-high commodity prices here are expected to persist for the rest of 2022 as the construction sector continues to grapple with the rising price inflation, high material costs, and a shortage of skilled labour.

Rising costs

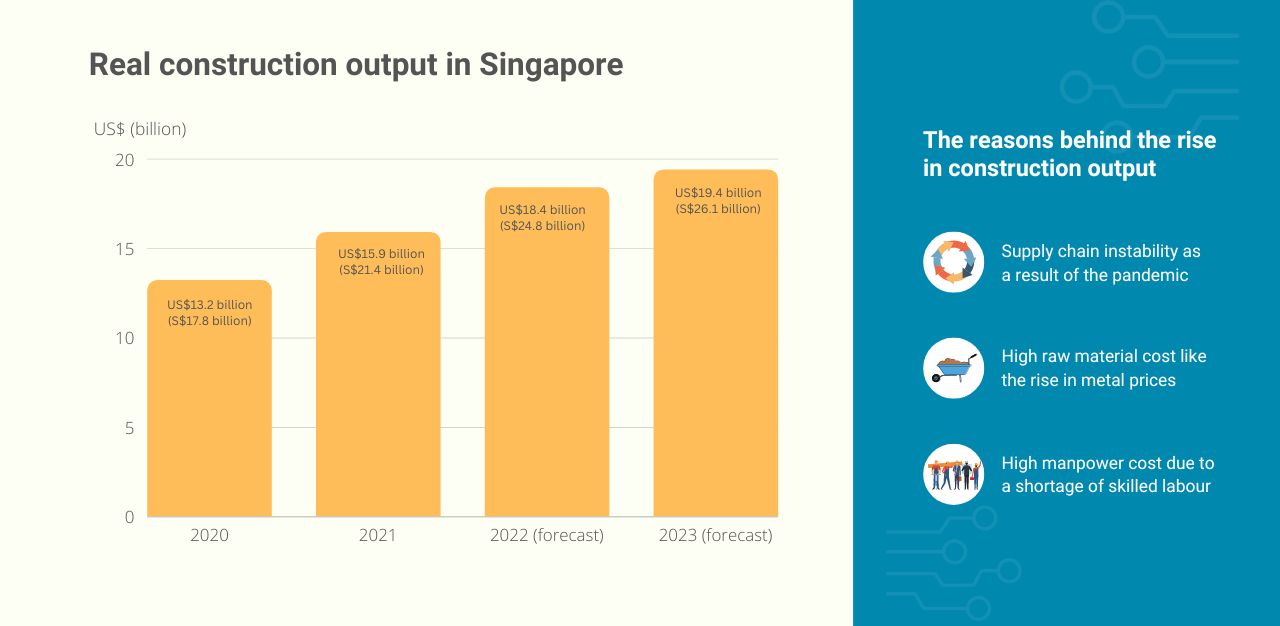

According to construction consultancy firm Linesight Singapore, the real construction output in Singapore will be rising. It was US$15.9 billion (S$21.4 billion) last year compared to US$13.2 billion (S$17.8 billion) in 2020, a yearly increase of 20.3 per cent.

This year, the real output is forecast to reach US$18.4 billion (S$24.8 billion), and a likely target of US$19.4 billion (S$26.1 billion) by 2023.

This recovery of the construction industry is mainly influenced by high material prices and supply chain instability, says the firm’s director Michael Murphy.

Mr Murphy says building costs rose drastically last year, and look likely to continue the trend into 2022.

‘’It will take at least another year, until early 2023, before we see prices of building materials stabilising to pre-Covid levels,” he says.

Mr Lye Kian Siong, director of construction firm People’s Construction, adds that the labour market strongly influences the recovery and growth of the construction industry.

He says that in the past, the costs of raw materials contributed a major part to the costs of projects. “But labour costs are on the rise and will soon take over as the main cost contributor,” he adds.

Mr Murphy says despite efforts by the Government to ease labour movement restrictions, some incoming labour restrictions still exist. The construction industry is working with the Government to come up with ways to expedite the flow of incoming labour.

Rising metal prices were a major part of rising overall construction costs in Singapore last year, but these prices are expected to drop this year.

Prices of steel rebar jumped 46.9 per cent last year while steel flat products climbed by 55.8 per cent — due to a combination of factors such as supply disruption, higher input costs, and improving demand from steel-consuming industries.

Government support

The impact of these rising prices led to the Government dishing out support in the form of protected steel prices to construction companies working on HDB projects.

‘’Support measures have assisted the contractors, especially for the costs for non-staff preliminaries (for example, equipment on rental) during the circuit breaker period,” Mr Murphy says.

However, the prices of lumber and cement rose sharply last year and demand for both these materials will continue to rise, with the estimated increased number of construction projects.

Demand for concrete is also expected to be driven by public-sector investment in infrastructure projects such as new MRT lines and stations as well as integrated transport hubs. Raw material imports for concrete are also expected to remain healthy to support the construction industry’s requirements.

Linesight expects concrete and cement prices to remain relatively high this year due to increasing raw material and conveyance costs. And this is expected to lead to higher construction costs of new development and renovation projects now compared to those before 2020, says Mr Murphy.

Two other major factors have also recently come into play — the war in Ukraine, and the rising number of Covid-19 cases in China, and the subsequent lockdowns.

“A big reason building materials cost more these days is that supply chains were disrupted during the pandemic. Those supply chains now need to catch up with demand and we are seeing concerted effort by stakeholders — material producers, port operators, transporters, and government agencies — to clear the backlog of supplies. Once that happens, the cost of building materials could start to decline,” he says.

Construction companies have received financial help from the government to implement technological innovations to automate their operations and reduce labour reliance.

Under an initiative jointly launched by the Building and Construction Authority (BCA) and the Infocomm Media Development Authority (IMDA) last September, construction companies can get up to 80 per cent of funding support to adopt robotics and automation solutions.

Mr Murphy says the construction industry in Singapore has had some time to try to plan around the implications. “For example, construction durations have been reviewed, planned construction sequences may have been altered, methodology of construction reviewed, in order to counteract material availability,” he says.

Automation and remote work

The construction sector has also adopted prefabrication construction techniques, which has helped to reduce schedule time and offset a portion of the reduced on-site labour availability, he adds.

Mr Murphy says future construction trends will see real estate developers and construction companies placing more focus on the design stages of projects as these stages will be more likely to be influenced by material availability, potentials for pre-fabrication strategies, and availability of local or recycled material supplies.

Mr Lye acknowledges the Government’s support and consultations with construction companies to find ways to alleviate the hardships that swamped the industry since the pandemic and supply chain disruptions.

He says the construction sector is capable of innovative strategies to cope with rising costs, but their success will be limited if the labour shortages persist.

‘’It is not possible to automate many aspects of the construction process, so measures such as design changes, and switching to prefabricated units, are ineffective as long as the labour shortages remain,’’ he adds.

RELATED: What is the future of sustainable construction in Singapore?

Join the conversations on TheHomeGround Asia’s Facebook and Instagram, and get the latest updates via Telegram.