Caught between filial piety and obligations

In a previous article, I wrote about trying to survive on the Workers’ Party’s proposed minimum wage of $1,300 for a week. While I managed to pass the challenge, it opened my eyes to how much impulsive spending I did and made me rethink the future of my finances.

For those in my generation, our parents are reaching retirement soon or have already retired. Many of us are also starting families or have a couple of kids of our own. We are also known as the sandwich generation, where we are “caught” between having to care for our parents, while also caring for our own financial wellbeing and that of our children’s.

In a recent survey, it was found that one in three millennials in Singapore believed that they would need to have to financially support their children, as well as their retired parents.

The idea of a sandwich generation is not new, of course. It is a cycle that comes up again and again, as new generations come up into the workforce.

Breaking out of a cycle with Up

But there is a way to break the cycle for the current sandwich generation, so says Laurent Bertrand, co-founder and CEO of BetterTradeOff.

“The solution is financial planning, specifically, starting early and planning with purpose and discipline,” he said.

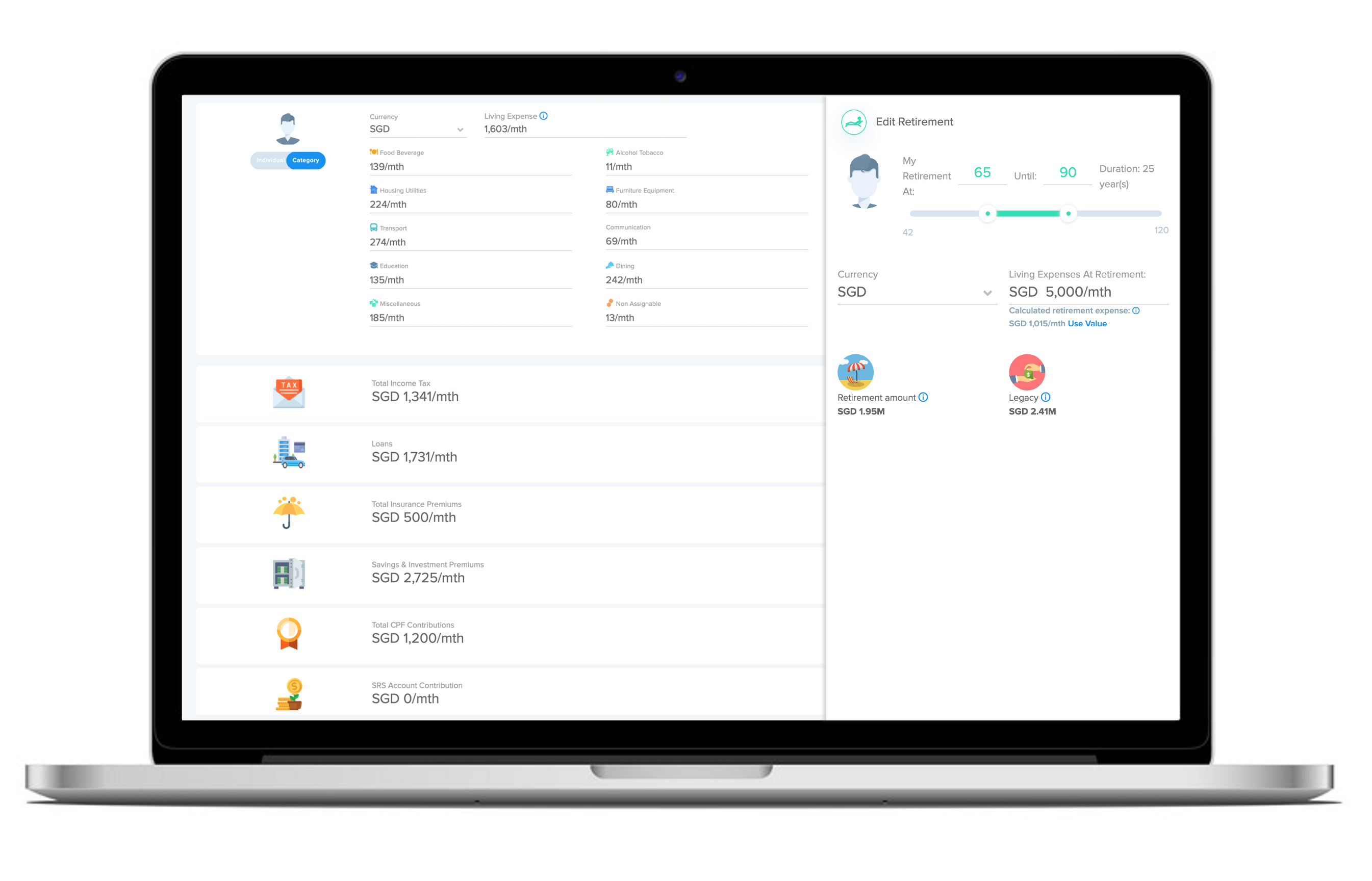

Sound daunting? It shouldn’t be, Bertrand believes. BetterTradeOff built the Up personal finance platform to make financial planning easy. The free-for-all platform simplifies the process, and makes it possible for anyone – regardless of net worth or financial acumen – to map out their future, and to also be introduced to the right financial products.

“Up is interactive and highly visual, which makes it easy to see, and truly understand, the impact of different decisions and outcomes in a way that is uniquely transparent and intuitive,” explained Bertrand. “This helps build trust and confidence in the financial planning process, by allowing people to see for themselves the value of sound financial planning.”

Since Up is a do-it-yourself platform, it encourages users to educate themselves on the planning process and financial fundamentals.

But don’t feel intimidated by having to walkthrough the platform yourself. “I’ve even used Up to educate my own children on personal finance,” Bertrand told TheHomeGround.Asia, speaking of the ease users would have with the platform.

How does Up work?

In as little as 15 minutes, even those with no prior financial knowledge or experience can build a comprehensive financial plan.

Up asks for the basics upfront to get you started: age, household composition, housing, income, savings, investments and expected retirement age – all of which can be updated and refined at any time later.

Then it does all the calculations needed for all current and future impacts, including relevant rules likes taxes or CPF with advanced analytics and Singapore statistics to ensure tailored and reliable results.

The platform gives users the option to map out what you want to achieve (starting a family or buying a house, for example) or even simulate the consequences of an accident. The financial situation is immediately updated, so that users can see the impact of each goal.

Users are encouraged to drag and drop their dreams to explore financial possibilities, which will ultimately build a plan fit for the user. It doesn’t just include long-term expenses, but also events like travel, weddings and home renovations.

Risk simulation within the tool also highlights the importance of incorporating protection, such as insurance, into their plan. Some risks to factor in would be the sudden death of a primary provider, or retrenchment during an economic crisis.

While the solution is designed to make the process simple, it takes care of the complicated stuff like incorporating local market data when running simulations and taking into account citizenship and other factors affecting local tax laws and financial rules and regulations for a highly detailed and robust plan.

Using Up for financial planning

“It always surprises people how even the smallest amount of savings can add up over time when they run simulations inside of Up, especially if that money is invested on a regular basis,” explained Bertrand. “Few people appreciate the compounding effect of investing on an ongoing basis.”

What many do not realise is that there is no right time to start investing. In fact, Bertrand comments that “time is not only on your side with investing, but also in buying insurance”.

This is true especially for insurance plans, which are usually cheaper when you are young and in good health. “Starting early here means you benefit from lower premiums, allowing you to get more protection for less,” he said.

Bertrand also emphasised the need to begin financial planning for all stages of life. “A plan needs to be dynamic and continuously looked at in order to stay relevant,” he said.

He also said that the common idea of focusing on growing wealth when you’re young and then managing that wealth once you are older does not work any longer. Instead, it is wiser to be getting the most out of your finances at all stages in life.

Bertrand breaks it down like this: “If you’re older and more dependent on the savings you’ve accumulated to live, a conservative view on investing that money is advisable. If you’re younger, you have more time to weather downturns and therefore can afford to be more aggressive.”

Whatever life stage you are in, the question ‘what if?’ should constantly be asked in order to build a plan that covers various financial scenarios, whether expected or unexpected.

Working with Up’s advice

What is special about Up is that users have the ability to make a sound and comprehensive financial plan for themselves or choose to work with an advisor to build on the information provided.

For those who prefer having an advisor take care of things, the tool Up Adviser can be used by their financial advisor to help users visualise their financial plans, so that users can review them on their own at their convenience. Up Adviser also reduces the manual work and form filling advisors currently face, so that they can spend more time understanding their clients’ needs, instead of administrative work.

Regardless of how Up is used, the platform is a start for those with no prior financial knowledge. Bertrand is sure that it is through being able to visualise your financial goals that will help this generation be better prepared for what is to come.

“Establishing a base of wealth and protection, no matter how small initially, is the key to breaking the sandwich cycle,” he said.

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.