The proposal for minimum wage

In October, the Workers’ Party (WP) called for a universal minimum wage starting at $1,300 per month for Singaporean workers.

Leader of Opposition and WP chief, Pritam Singh, said that the implementation of minimum wage is “not just a moral imperative, it is an act of national solidarity, one that is even more relevant in today’s economic environment”.

His comments were in a Facebook post dated 12 October in response to Minister for Manpower Josephine Teo and secretary-general of the National Trades Union Congress (NTUC) Ng Chee Meng, who announced a new Tripartite Workgroup the day before.

Teo, Ng, and Singapore National Employers Federation President, Robert Yap initiated the formation of the workgroup, which will expand on the current Progressive Wage Model (PWM) to “cover more workers while protecting their employability”.

The PWM, which has also been called ‘minimum wage plus’ by its supporters, works on the premise of providing minimum wage to workers in specific industries, as well as required wage increases they must be given as they progress in their careers.

The minimum wage amounts for the different sectors are adjusted incrementally over the years.

WP Member of Parliament-elect Jamus Lim has criticised the PWM, claiming that there are close to 100,000 workers who remain below minimum wage. He also said that the model “ties wages to job function, which still gives too much room to employers to cut corners, without redressing power differentials.”

When Lim posed the question on the number of Singaporeans taking home $1,300 per month, Senior Minister of State in the Ministry of Manpower Zaqy Mohamad clarified that the number stands closer at 52,000.

The proposed $1,300 amount refers to Singapore government data that indicates that a four-person household would need $1,300 to cover necessities, such as food and shelter.

Living off minimum wage for a week

With that in mind, I decided to take on the challenge of living off the proposed amount of $1,300 for a week.

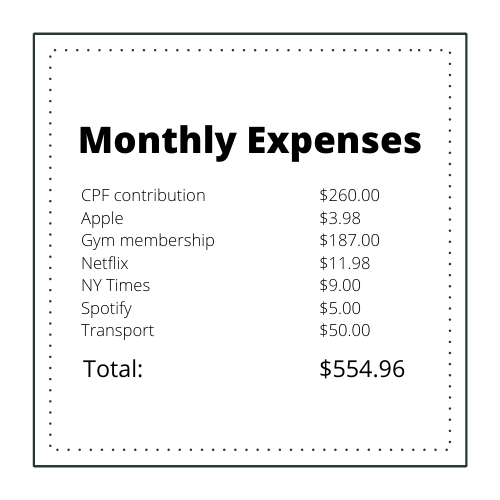

Here’s my breakdown of my budget:

These are recurring subscriptions I have, some of which are shared with friends and family, such as the ones for NY Times and Spotify.

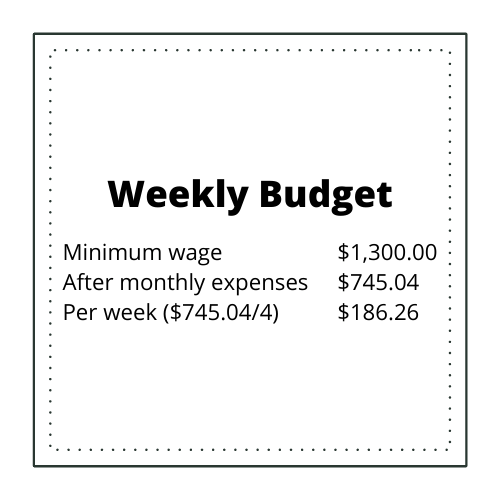

And the weekly budget I will be working with:

Something to note: I still live with my parents, who do not expect me to cover expenses like utilities and food. I am also single and nowhere near being in a relationship, as such, I don’t have to pay for dates, or plan my finances around a wedding or upcoming HDB built-to-order/resale flat.

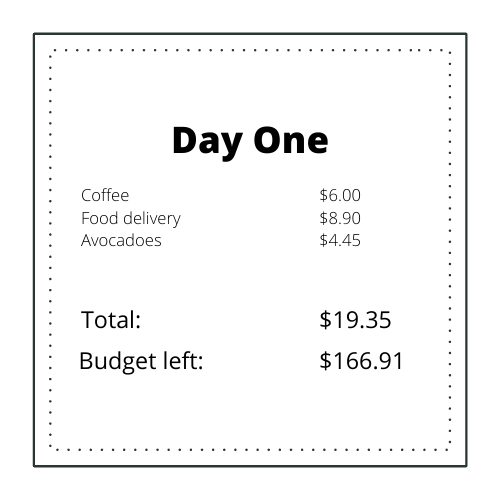

Day One

The week starts off poorly. I forget that I’m starting the challenge mid-week but have already spent $6 on a gourmet-style coffee from a kiosk outside Paya Lebar Quarter before heading to the office.

My next big spend is on lunch; the entire company is involved with filming this afternoon, so we choose to order in from a nearby eatery. I chose the ayam penyet and an ice longan drink.

They aren’t exactly the cheapest options on the menu, but still relatively affordable. I also know that ordering the drink was unnecessary, since I still had my coffee from this morning.

On my way home, I stop by Cold Storage to see if I can pick up groceries for meal prepping for when I work from home. I don’t mean to be that millennial, but avocadoes are on sale. They’re three for $4.45 – an absolute bargain, so I buy them to have for my meals in the days to come.

Day Two

It’s a WFH day so my meals are more or less set, since I still live at home with my parents and they cover the cost of groceries. I eat the first of my three avocadoes for lunch with a fried egg.

Today’s another filming day and I have to be on location by 1 p.m., and of course, I am late. The only option for me is to take a Grab, so that’s the first of my spending for the day.

The second spend I have is at a café in Funan. My editor and I have made plans to meet up somewhere central, since she’s an Eastie and I’m a Westie (West Side Best Side).

She shares concerns about me spending $7 on a latte when she knows I’m on a tight budget this week. I brush it off as a “business expense”.

We end our meeting quite late and I’m tempted to just dapao food from Funan for dinner, knowing full well my mother has already prepared a meal back home. I manage to resist temptation, though, and make it back home without spending another dollar. I count it as a small victory.

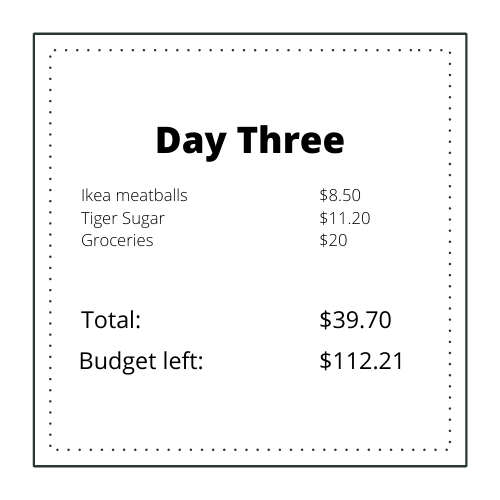

Day Three

It is another WFH day for me and it seems likely that I wouldn’t be spending money at all today, since I have no plans to head out. Lunch is my second avocado, which I have served with toast like a true-blue millennial.

But, my sister calls asking if I want meatballs from Ikea since she’s there with some friends. I haven’t had their meatballs since circuit breaker so immediately agree to an order without thinking much about the price.

When she comes back home, she also bills me an additional $20 for a grocery order I had forgotten to pay her.

A friend sends a text about meeting up for a bit at Holland Village, near where I stay, as she has a gift for me. We catch up and I feel bad for getting a gift out of the blue, so offer to treat her and her sister to bubble tea. She picks two cups of Tiger Sugar’s signature drink, which sets me back by quite a bit.

I head home just in time for the ONE Championship MMA fights, which our new writer is covering. Thankfully, the fights are free to watch on their YouTube channel.

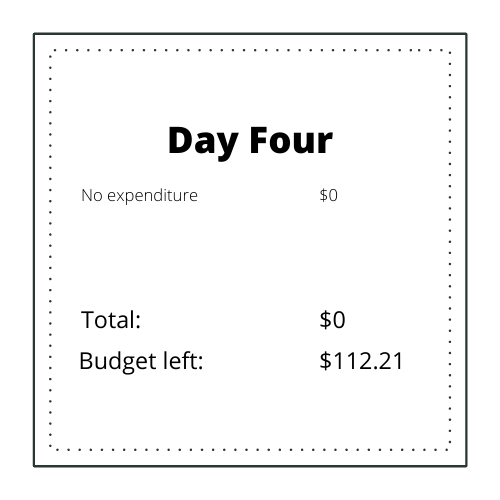

Day Four

I’m quite surprised at how much I have left, but I haven’t actually made it through a single day without additional spending, so that’s my challenge for myself for the weekend.

I have a gym session and not much else planned for the day. It’s Halloween, but I’m not one to dress up or party so I’m home all day.

It is a friend’s birthday, however, and I want to send her a bouquet of flowers, but there isn’t anything available that wouldn’t eat into most of the money I have left over.

Instead of a gift, I send her a ‘happy birthday’ text message and promise to celebrate once this challenge is over.

The day ends quite uneventfully, since all my meals are provided for at home (yes, I ate the last of my avocadoes today).

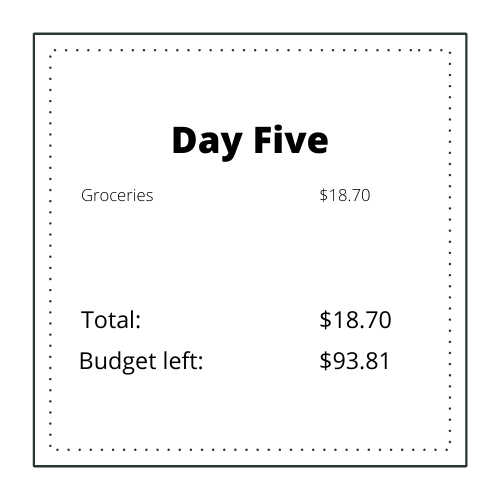

Day Five

I’m mostly at home again, save for one more session at the gym. Sundays are usually reserved for family time, so again, I’m guaranteed free meals, as long as I’m hanging out with my family.

I do, however, usually treat myself to an acai bowl or power smoothie after my workout but skip it this time round in a bid to save some money. My stomach growls on the way home and I fill up on snacks instead, undoing all the cardio I just did at the gym.

My sister and I decide to do another grocery run after dinner. I’m here mostly for the snacks, but we also heard there were some good deals on smoked salmon, yoghurt and cereal. My share works out to be $18.40 by the end of the night.

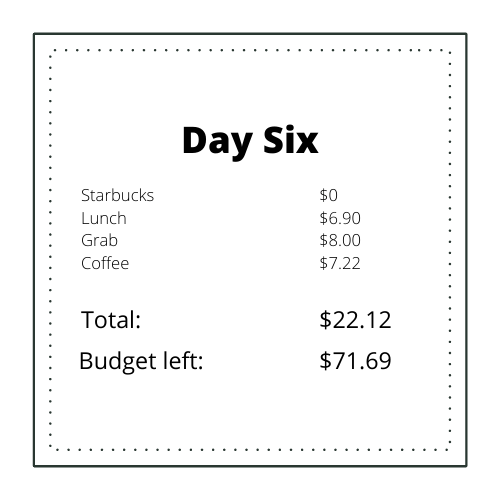

Day Six

I am back in the office today. I spent most of the previous night pushing out an article and I am drained and in serious need of a caffeine boost.

I could go for the cheaper Nanyang-style kopi, but again, I am that millennial and want Starbucks instead. Besides, they just launched their Christmas drinks and I want to try out their newest one for my Starbucks review “blog”.

I go to pay and find that I have a free drink tagged to my account for my birthday month. Nice! It saves me $8.40 this morning.

Lunch today is at a food court and I get yong tau foo – my go-to for something filling and cheap – and iced tea, all for less than $7.

A post-lunch meeting runs late, and I end up taking a Grab to another appointment. Once that’s over, I have time to kill before my sister’s birthday dinner. I settle at a café at Raffles City and have another coffee while waiting.

Thankfully, my sister’s birthday festivities are paid for by my parents. My sister and I have never been ones to exchange gifts, preferring to celebrate just by spending time with each other.

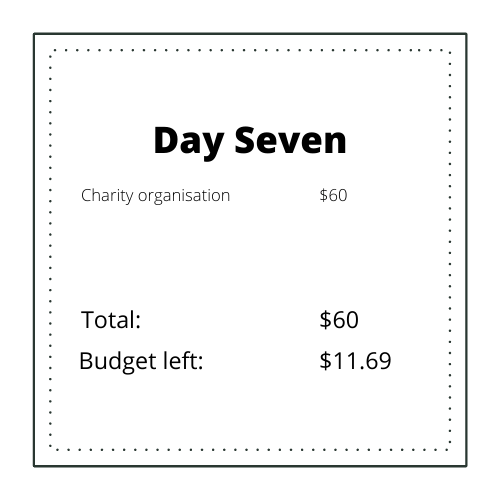

Day Seven

It’s my last day of the challenge and I’m left with about $70. I’m honestly surprised by how much is left, and how much I was able to control my reckless spending habits this week.

As it is my last WFH day, I am eating at home once more. My sister and I discuss the challenge and how it actually turned out pretty easily for me.

Given how privileged I have been in this challenge, I tell her I want to do something meaningful with the last $70. She tells me of a charity organisation that wants to help migrant workers celebrate Deepavali, since most have not been able to go back home.

They are collecting donations to hold a pizza party for them, and people can donate pizzas at $15 each. I put my name down for four pizzas, ending the week with $11.69.

What I learnt

When I started this challenge, I expected to fail quite miserably. I’m quite the impulsive shopper and don’t think twice about tapping my credit card on a terminal or shopping online for whatever catches my fancy.

Not having to pay for bills, rent, and other household expenses helped my cause tremendously, as did the lack of a packed social calendar.

This privilege I have does not translate to the many others who live off minimum wage, of course. The $1,300 is also stipulated to feed, shelter, and clothe an average family of four, while I only had myself to feed.

This experiment was not done to criticise the minimum wage model or the progressive wage model. Rather, it was to see if a millennial with poor spending habits could spend within her means.

I believe the minimum wage model proposed by WP has its merits. Lim, who is also an associate professor of economics at ESSEC Business School, has provided strong evidence that a minimum wage policy can work to help Singaporeans in need, without putting a strain on employers or the government (Lim is strongly against the idea of the government paying minimum wage, rather “the burden is borne mostly by higher process consumers pay, and in part by firms”).

The PAP can continue to argue that the PWM allows workers to take ownership of their career progression by acquiring more skills through training, but we also have to recognise that not everyone is in a position to upskill, such as not having the time to do so.

If anything, what WP has done is bring to the table a discussion on how Singaporeans are able to survive through economic crises, such as the current recession brought on by the COVID-19 pandemic.

While there is no exact poverty line in Singapore, poverty in Singapore increased by 43.45 per cent in three years from 2012 to 2015. Poverty also mostly affects the elderly, with their rates increasing 74.32 per cent within the same period.

The next age group to be affected are those aged 15 to 34. Research has found that many young Singaporeans face difficulty over finding a job or are subjected to low-paying entry-level jobs that do not meet basic survival requirements.

It is high time the government reviews and evaluates again what constitutes poverty in Singapore, which is still largely invisible in a country considered one of the wealthiest and most well-developed in the world.

As long as both sides continue to debate about this is parliament, we too should continue the conversation. For those of us with the privilege of earning much higher than $1,300, we should also reflect on how we are spending our money and what we can do to help the invisibly poor among us.

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.