Just last week, Reddit user bbygirl17 made a post asking fellow users if they were frustrated with being “poor” in Singapore. She stated that she was currently a final-year student in university, and was perplexed about having to support herself after graduation:

“Whenever I think about paying for myself in life I get so frustrated… Looking at house prices and car prices make me feel so poor despite being comfortably middle class (living in a HDB, family owns card, can go holiday to Malaysia frequently, eat at restaurants occasionally).”

She wrote that she had a “mild panic attack/breakdown” while looking at house prices, and wondered if she felt that way because of her personal expectations, or if money anxiety was a common phenomenon amongst Singaporeans.

Points were made

A general skim through the comments on the post seem to reflect a general consensus that bbygirl17 should learn to be content with what she has now, and not to stress out because she has ample time to build her wealth.

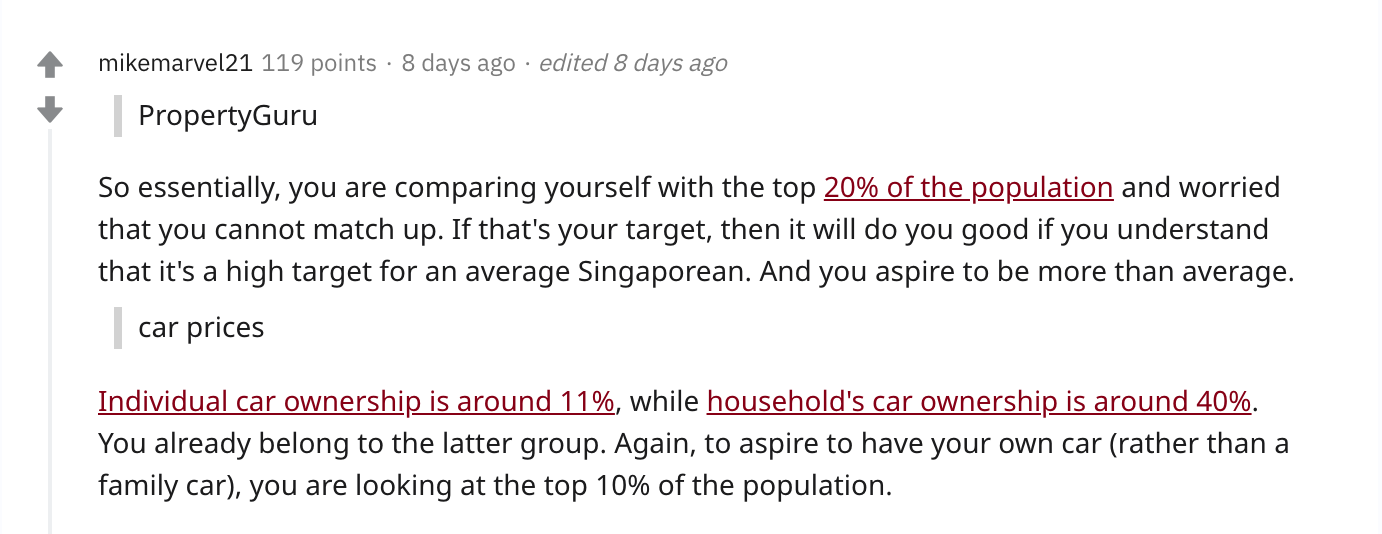

Some users also pointed that aspiring to own a car meant that she was comparing herself to the top 20 per cent of the population, and that her parents have had ample time to build up their wealth over the years.

“Poor is a matter of perspective”

In particular, comments from two users, Catbear83 and bobo_chacha brought up the fact that “poor is a matter of perspective”, and feelings of money anxiety were caused by having a scarcity mindset, the belief that there will never be enough (be it food or money), which thence leads one to cling onto everything out of fear of coming up short.

This begs the question — do most of us have a similar mindset when it comes to money and wealth? What constitutes “enough”?

Although Singapore is considered one of the most highly-developed countries in the world, it’s no secret that poverty still exists amidst the rungs of society.

In 2019, the Household Expenditure Survey found that the bottom 20 per cent of households spend about $2,750 a month, on an income of $2,235, indicating a shortfall of about $335 each month. Associate Professor at the National Technological University Teo Yeo Yenn noted that this was a worrying trend, as it is a sign that the well-being of these people are compromised.

“People generally adjust spending to expected income, meaning that people with lower income already forgo spending that higher-income people consider basic needs, including educational needs such as tuition, nutritious food, healthcare, and leisure and social activities important for overall well-being,” she said.

Rice Media also provided an insight to how the poor live in Singapore, through their series on Jalan Kukoh, one of Singapore’s rental housing areas. It is deemed as one of the poorest neighbourhoods in the country.

For the rest of us, are we really poor, or just materialistic?

Without having to delve into the intricacies of poverty in Singapore (for the record, yes, there is much we can do to help those in need, and much we can do to change the way poverty and inequality are discussed in Singapore), are we allowed to feel the way that we do?

We may earn a relatively decent salary, but sometimes we can’t help but wish that we had a little more disposable income (myself included).

I used to work for a nonprofit organisation, where I was paid below the market rate for a graduate. That was of course expected, given the nature of the organisation, but there were definitely times when I wished that I had picked a better-paying job, just so I could afford more coffee.

Even though I now earn more, I still do sometimes feel a bit frustrated at how little I have left after paying for my bills and other essentials; the thought of having to pay for a house and wedding still intimidates me. And I’m not even thinking about a car.

Maybe these feelings are justified?

To be honest, I can understand where bbygirl17 is coming from. Coming from a middle-class background as well, I’ve gotten accustomed to a certain standard of living because of what my parents have provided me with. I’ve also developed some pretty unwise spending habits over the years (i.e., my debilitating iced coffee addiction). Trying to achieve the same level of comfort through my own means is definitely a daunting task.

I’ve heard my parents’ stories about their first few years of work — from having to take on multiple jobs in different industries, to sleeping overnight in the office just to finish work, they’ve definitely gone through much more than I have.

I am thankful for their hard work, which has given me a substantial head start. But as I step out into the workforce and try to carve out a career for myself, I realise that times are different. Things are more costly, there are different challenges in the job market, and last but not least, we’re in the middle of a pandemic.

As I sip on my overpriced latte and ruminate on this this issue, I reckon it’s okay to feel a bit overwhelmed about the future and the cost of living from time to time. It’s okay to lament about not being to afford certain ‘wants’ as well. But let’s not let these minor grumbles distract us from the reality that it’s not actual poverty, but perceived poverty on our part. Let’s work towards channeling that energy into something more productive, like investing, or helping those in need.

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.