Four university students created Money Talks, a kit designed to help parents teach their children financial literacy. TheHomeGround reviews the kit.

In times of scarcity, money becomes the talk of the town – it most definitely does during a recession, when a lack of financial literacy becomes more apparent, and more concerning, than ever before.

The OCBC 2020 Financial Wellness Index drives home this very point, with results revealing that many adult Singaporeans are faring below expectations when it comes to handling finances. Only about half of Singaporeans have sufficient funds to sustain themselves for six months should they lose their jobs, and nearly three quarters of Singaporeans are falling behind on their retirement plans.

READ: OCBC Survey: Millennials Most Careless with Spending – Are We Just Bad With Money?

For four university students – Asyiqin Musta’ein, Mallorie Ng, Melissa Phay, and Esther Yeo – who are stepping into the workforce this year, financial literacy (or the lack of) has become forefront in their minds. Upon realising that a lack of financial knowhow was a common denominator among them (and some of their peers), they came together to create a campaign tackling just that.

With the tagline of “Go beyond the piggy bank”, the four young women are on a mission to educate and inspire children to take charge of their finances.

And so, Money Talks was born.

About Money Talks

We all know that good habits start from young, and the Money Talks team is looking to do just that by helping parents instil good financial habits into their young children.

According to their survey of 336 parents with children aged between six and 12 years old, less than 40 per cent of parents believe their child has the appropriate amount of financial knowledge for their age.

Among these same parents, a vast majority were also convinced of the importance of financial education from a young age, however, only about 30 per cent of them are actually engaging their children in financial matters.

If parents are so convinced of the benefits of financial education, why is it not happening? Well, Money Talks discovered a few reasons why this is so, including a lack of available resources on childhood financial education, scepticism about children’s comprehension abilities, and hectic schedules.

With these concerns and factors in mind, the Money Talks team consulted with the Institute for Financial Literacy (IFL) and jointly created the Money Talks Kit, a free, ready-to-use financial education resource to kickstart financial education for young children with lessons that will stay with them for life.

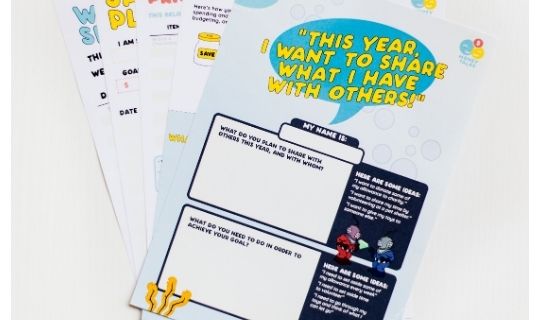

Available in both physical and digital formats, the Money Talks Kit contains a deck of Conversation Kickstarter Cards, fun activity sheets, and other supplementary materials to help parents engage in weekly money conversations with their children.

The kit is separated into three sections in a bid to forge a comprehensive and strong foundation to childhood financial education. Namely, the three sections are to Save, Spend, and Share.

Intrigued, TheHomeGround got our hands on a digital kit to try for ourselves.

READ: What Do We Lose When We Stop Speaking a Language?

TheHomeGround reviews the Money Talks Kit

Two members of our team had a go with these digital kits. Our first guinea pig was Kevin Wong, a parent of four, an ideal representative of the target audience Money Talks was aiming for.

The latter was myself, a young adult whose childhood financial education involved my parents going, “Hand me your ang bao money and we will save it for you,” and not much else.

The Highs

The kit’s design was a definite winner. At first glance, it instantly attracted my attention with its colourful design. The thought put in by the Money Talks team was evident, with each deck of cards coming with their own section covers for better organisation.

The digital kit was simple and instinctive to use, with clear instructions on how to print out the cards and arrange them. Even the activities included had been thoughtfully designed to ensure involvement from the children as well, with do-it-yourself and colouring activities to help parents better engage their children in finance-related conversations.

Kevin found the Conversation Kickstarter Cards particularly useful, as it helped him to structure finance-related conversations in a comprehensive manner and “make it fun and engaging for the kids”.

Both Kevin and I appreciated that the conversation pointers go beyond the “I” perspective, and encourages children to think about finances from a family standpoint as it paints a more realistic picture of how money matters are handled and discussed when they are more grown up.

By thinking of the family as a whole, it also encourages children to think beyond their own needs and consider the needs of others around them, which is a great lead-in to the Share segment of the Money Talks kit, another section lauded by Kevin!

Kevin remarked, “Giving to charity and the disadvantaged was a welcome inclusion and helped to build character in the kids.”

When speaking with Esther, she also emphasised that by teaching kids about sharing, it has the added benefit of teaching kids to budget, as it forces them to set aside part of their money for this very purpose.

For myself, I found the segment on how to save for a rainy day in the Save segment helpful. As a child, my own experience about saving often stemmed from a desire to purchase something. Saving for a rainy day was not something that I even considered at a young age but is no doubt an important part of financial literacy.

Introducing concepts like saving for a rainy day at a young age can come in useful later for introducing more complex concepts like insurance and emergency funds, both of which are vital in adulthood.

READ: The Case for Educating Our Kids on the Influence of Ads

The can-be-improved

While trying out the kit with his children, Kevin noted that parts of the Save section were a little challenging for them to grasp. Specifically, he pointed out that topics such as banking withdrawals, deposits, and interest rates were difficult for them to comprehend.

One of the founders, Esther, did clarify that incorporating such topics were only done in accordance with advice from child financial literacy experts, but we felt it would be helpful for the kit to have included in greater detail suggestions or demonstrations on how to better explain such concepts to children, as parents may not have the savvy to do so.

Additionally, I felt that while the accompanying activities are great ways for children to physically get involved in the financial education process, more visual demonstrations such as images and icons can be used, especially for younger children, to explain these concepts.

For instance, stickers can be introduced for the Compare Prices activity to illustrate the different items being purchased and price difference (increase or decrease) to allow young children to take part as well.

The verdict

Overall, both myself and Kevin had high praise for the Money Talks Kit.

It is a great way to kickstart finance-related conversations with children who are new to the concept. Furthermore, the conversation cards and activity kits are portable enough to incorporate into day-to-day lives, allowing parents to carry out financial education on a regular basis without having to go out of their way to do so.

While the Money Talks Kit has done a stellar job at introducing financial education to young children, we would love to see financial education extend beyond this one moment in time and become integrated into the daily conversations of families nationwide.

Perhaps future iterations of this kit can be developed to grow with the children, eventually touching on more “adult” issues like making money, wealth accumulation, and more.

Esther and her teammates intend to hand over the reins to a partner post-graduation, but they have definitely set the foundations for what could be a new wave of financially savvy children in the next generation.

And so, are you ready to talk about money with Money Talks?

If so, you can learn more about their campaign here, and download your own digital kit here.

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.