Singapore’s electricity sector started out bright in 2017 as the country approached the last leg of a long journey in the liberalisation of the market. Twenty-five electricity retailers slugged it out for a piece of the fully liberalised pie that will be in 2018 and the range of services offered brought immense benefits to end-consumers.

Fast forward to 2021.

iSwitch Energy, the city-state’s largest independent electricity retailer, bowed out from retail operations and at least three more retailers followed suit, turning off their lights and exiting operations as staggering spikes in spot electricity prices and the inability to hedge adequately sent their businesses reeling.

The spikes are due to a confluence of factors such as gas curtailment from Indonesia’s West Natuna and “low landing pressure” of the gas supplied from South Sumatra, the Energy Market Authority (EMA) told The Business Times (BT) last October.

Was the move doomed to fail as soon as it started? One market watcher told BT that in such a dense, aggressive environment where retailers are offering up to a 30 per cent discount, only 40 per cent have been converted. “That to me is a 60 per cent failure. The reasons to switch are compelling but why are the rates so low?” he asked.

More choices and lower prices

When Singapore’s electricity retail market was liberalised, the plan was to first give business consumers then the everyday consumers, more choices when buying electricity, while continuing to ensure a reliable electricity supply.

Business Lecturer at Singapore University of Social Sciences (SUSS) Tan Tsiat Siong says: ‘’With more players in the market, they (the retailers) will compete for market shares, with greater incentive to be efficient and lower prices for consumers.’’

Since 2001, Singapore’s electricity retail market has been progressively opened, leading to the formation of the Open Electricity Market (OEM), says a spokesperson for EMA. “With the OEM, consumers can choose to buy electricity from SP Group at the regulated tariff or from a retailer at a price plan that best meets their needs.”

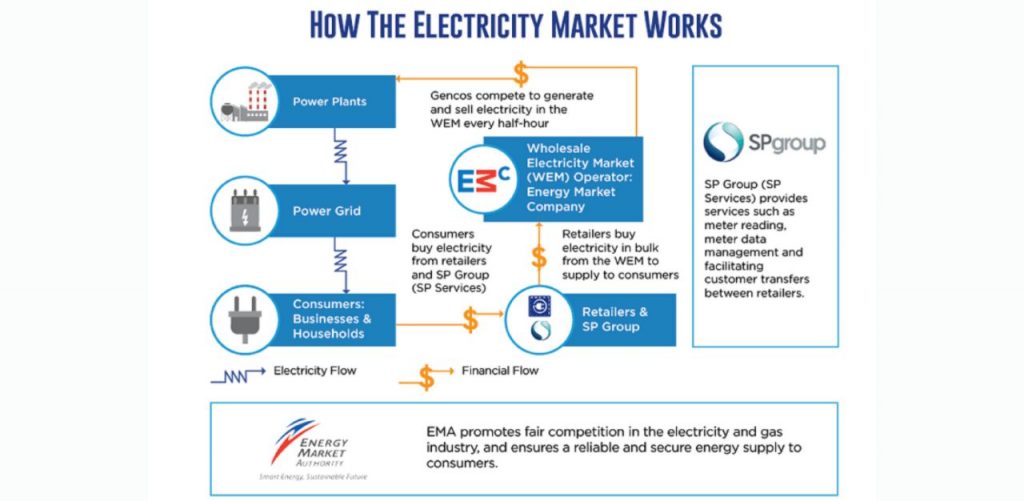

Under an open and competitive market, electricity retailers will buy electricity through the wholesale market to sell to consumers.

Professor Subodh Mhaisalkar, Executive Director of the Energy Research Institute at Nanyang Technological University, says that the launch of the OEM in 2018 had followed earlier electricity market liberalisation programmes in the European Union, Oceania and other countries. ‘’This has brought savings ultimately to consumers, including in Singapore,’’ he says.

When the OEM was launched in 2018, households were able to choose electricity price plans from more than 10 retailers, designed to suit their home and work needs.

In the past few years, the electricity retailers could offer prices lower than the regulated tariff from SP Group. This was due to wholesale electricity prices that were depressed below the long run marginal costs due to overcapacity in generation, and oversupply of gas.

Civil servant Nalini John, 49, and her family made the switch from the SP Group to SembCorp Power four years ago.

‘’The price plans were more varied compared to the price plans from SP Group. The contract was also only for a year at the time, so we could always switch back (to SP Group) after the contract ended, without any undue impact. But so far, the service and plans from SembCorp have continued to be good,’’ she says.

Civil engineer Mohammad Asuri bin Ahmad, 55, switched to Geneco four years ago, and has also been satisfied since.

He says: ‘’The price plans better fit our household needs and are more reasonable in prices. The service has been good, and the customer service is also prompt and able to answer our queries quickly.’’

Unexpected change

But that bubble certainly did not last long.

Last year, Singapore’s wholesale electricity market ‘’experienced unprecedented volatility as global gas prices rose to record levels due to unanticipated demand for gas and disruptions in gas supplies,’’ says the EMA spokesperson.

Since last September, wholesale electricity prices here have risen dramatically because of the global energy crisis, driven by increased global demand worldwide, production outages due to cold winter months and disruptions to piped natural gas supply from Indonesia.

The current Russia-Ukraine conflict will cause further disruptions, and further oil and gas hikes are likely, experts say.

The earlier low energy prices led many electricity retailers here to under-hedge their positions.

Dr Tan says, “When gas prices spike suddenly, retailers would then be buying electricity at a price much higher than the price they are selling to households, therefore incurring a loss. Some of these fixed price plans last for two years, and this would mean sustained losses for the retailers. It is a matter or over-committing to low prices and not expecting the energy price spike.’’

Prof Subodh says the electricity retailers had to buy electricity at a lower price from the wholesale market and pass on savings to the consumers to be profitable.

He says, ‘’The retailers need to institutionalise robust financial risk management plans in place to ensure they can provide their services over a long term. Some retailers who could not manage this well exited the market.’’

Dr Tan says that the retailers made commitments to low prices without any room for flexibility, rendering them unable to pass off price fluctuations. Prof Subodh adds that other factors that adversely affected the exiting retailers included market share, company assets, business strengths, and relationships with the generating companies.

The EMA says the exits were ‘’expected in an open and liberalised electricity market like Singapore’s’’.

To date, six electricity retailers have left the market. Three of them – Best Electricity, Ohm Energy and UGS Energy – have committed to providing an ex-gratia payment to ease their customers’ transition to SP Group or other alternative electricity retailers.

Six of the remaining retailers – Geneco, Keppel Electric, PacificLight Energy, Sembcorp Power, Senoko Energy and Tuas Power – are backed by power-generation companies. The other two, Union Power and Sunseap Energy, are now offering plans with only marginal price differences from the regulated tariff.

Too many players in the field

Dr Tan says having too many retailers in the OEM led to higher electricity prices as the retailers were unable to ‘’reap economies of scale nor develop financial resilience’’.

He says the authorities should set clear rules to monitor the retailers, ensure sustainable business practices, and then let market forces do their work.

Dr Tan says: ‘’There could be revisions of the hedging requirement to make sure retailers are protected against cost risks. This will indirectly increase the barriers to entry; firms with smaller capital would then find it difficult to meet the hedging requirements. They will exit the market because they cannot sufficiently protect themselves against market risks.’’

Time for a review

On 3 March, Second Minister for Trade and Industry Tan See Leng told Parliament that the EMA is reviewing the existing regulatory and licensing framework for electricity retailers, with a view to strengthening it to better protect consumers.

The EMA spokesperson says Singapore’s open economy made it impossible to totally insulate the country from the impact of higher global costs.

Prof Subodh adds that market consolidation was ‘’not unexpected and not necessarily a negative’’.

Cushioning higher prices

According to EMA, most consumers have been cushioned from the volatility in the wholesale electricity market as they are either on fixed price plans, discount-off-tariff plans or the regulated tariff.

Its spokesperson adds that the Government has support measures for households and businesses with higher electricity costs, such as double the U-Save rebates to offset utilities expenses as announced at Budget 2022.

EMA has also worked with SP Group and the remaining retailers to help consumers affected by the exit of their retailers.

‘’Under the Code of Conduct for Retail Electricity Licensees, retailers who wish to exit the retail electricity market are required to first approach other retailers to take on their customers under the same contractual terms and conditions. If the exiting retailer is not able to novate their contracts to another retailer, its customers will be transferred to SP Group,” its spokesperson says, adding that affected customers will have the option to accept the transfer, or switch to another retailer of their choice.

“For household consumers, the retailers are required to refund any remaining security deposits after offsetting outstanding charges. For businesses with average monthly consumption of 4 megawatts-hour (MWh) or more and do not have the option of switching to the regulated tariff, EMA has worked with gencos and retailers to offer monthly fixed price plans under the Temporary Electricity Contracting Support Scheme (TRECS) which will be in place until May 2022… . For business consumers with an average monthly consumption of up to 50MWh, Sembcorp Power is offering longer-term fixed price plans,’’ the spokesperson adds.

Join the conversations on TheHomeGround Asia’s Facebook and Instagram, and get the latest updates via Telegram.