The financial growth of esports around the world continues to occur at a truly remarkable pace. Not even two decades ago, it was common for even the largest and most prestigious esports tournaments to have total prize pools of just US$10,000 or less. Third-party investment was almost non-existent, sponsorships were scarce, and merchandise related to esports teams was only sold to a niche market.

Today, this is certainly no longer the case: major tournament prize pools now regularly total well over US$1 million, and most elite esports teams have many sponsorships and generate much revenue through the sales of their merchandise. Esports has even seen a great deal of investment from angel investors, media companies, venture capital funds, and even celebrities and professional sports teams.

Leading titles

The video games which are currently the biggest revenue drivers in the esports world are Dota 2, Counter-Strike: Global Offensive (CS:GO), Fortnite, League of Legends, and PlayerUnknown’s Battlegrounds (PUBG). Created and backed by leading developers such as Valve, Epic Games, Riot Games, and PUBG Corporation, these marquee titles have not only drawn millions of players and viewers from across the globe, they have also brought much revenue not only to developers but also tournament organisers and other entities associated with esports.

Rising tournament prize pools

Of course, the stunning rise in esports tournament prize money has to be mentioned as well. To provide an example of how dramatically prize pools have increased, consider the CS:GO tournament DreamHack. The DreamHack Winter 2005 tournament held in Jönköping, Sweden, had a total prize pool of just US$3,000 (S$5,700 in 2021). Twelve years later, DreamHack Las Vegas, held in 2017, saw participating teams playing for an impressive prize pool of US$450,000 (S$680,000).

This is not even close to the biggest prize pool in esports. Over the last few years, multimillion-dollar esports tournaments of various titles have been held on a regular basis. The most lucrative of these to date is Dota 2’s The International – the recently-concluded 2021 edition of the tournament featured a prize pool of US$40 million (S$53.9 million).

Another tournament which garnered much attention for its massive prize pool was the 2019 Fortnite World Cup in which a total of US$30 million (S$43.9 million) was up for grabs. The exact date of the tournament’s next edition, however, is yet to be announced, though that will be closely watched as an indicator of the health and longer-term financial viability of esports.

Top esports players of today thus make a great deal more money than their predecessors of even a decade ago could ever have imagined.

Chris Tran, the Head of Esports for Riot Games Southeast Asia, Taiwan, Hong Kong and Macau, regards this rise as a correction allowing esports tournaments to display their true value. He says, “In comparison to many other sports, esports prize pools are now beginning to catch up to the value that esports actually provide in terms of audience reach and entertainment scale.”

The role of sponsorships

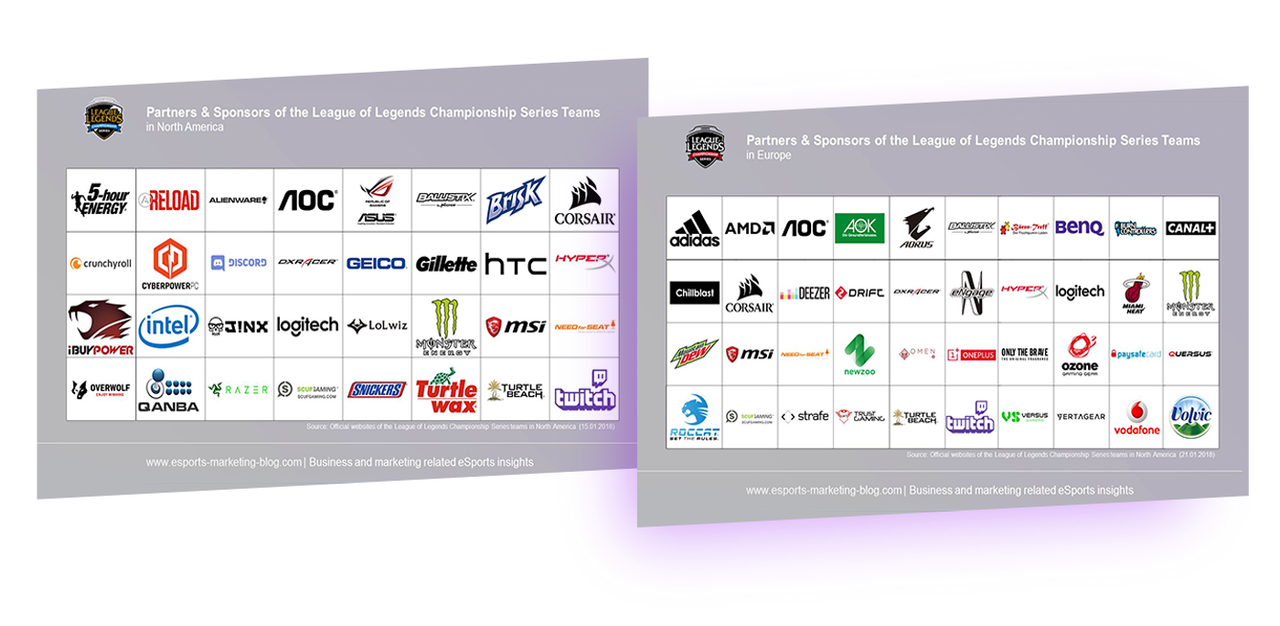

Sponsorships have also played a role in making the esports industry more lucrative than ever before. Esports sponsorships are no longer limited to just computer brands or companies selling gaming equipment. Entities such as PepsiCo, BMW, Comcast, FTX, and even the US Air Force have sponsored various esports teams and players.

Additionally, much of the financial backing for esports tournaments comes from sponsorships. The more entities sponsor a tournament, the larger its prize pool can become and the more resources the tournament organisers will have to stage a truly world-class event. As an example of just how high-profile esports tournament sponsors have become, the PUBG Mobile Global Championship held last year was sponsored by OnePlus, Qualcomm, and Mountain Dew. This year’s League of Legends World Championship, meanwhile, featured sponsorships from companies including State Farm, Verizon, Spotify, and Mercedes-Benz.

According to Tran, with growing sponsorship revenues, the industry is able to invest and reinvest in tech innovations. “This is one of the strengths of esports – the ability and the drive to push the envelope,” he says.

He also points out that sponsorships must be pursued with the players at top of mind. “Our goal (at Riot) is to engage in meaningful partnerships that create new, unique products and media experiences for our fans.” Some recent examples, he points out, include Red Bull, Secret Lab and HyperX for their VALORANT Champions Tour (VCT) Masters 2 tournament, and also Mercedes Benz for their League of Legends 2021 World Championship, which saw Mercedes and Riot’s design teams co-creating a commemorative championship ring for the winners of the 2021 championship.

Other examples include the involvement of Louis Vuitton to capture the synergy between fashion and gaming, and also Spotify, which signed a first-of-its-kind, multi-year partnership to be the exclusive audio-streaming partner for League of Legends global events.

Esports as a viable investment opportunity

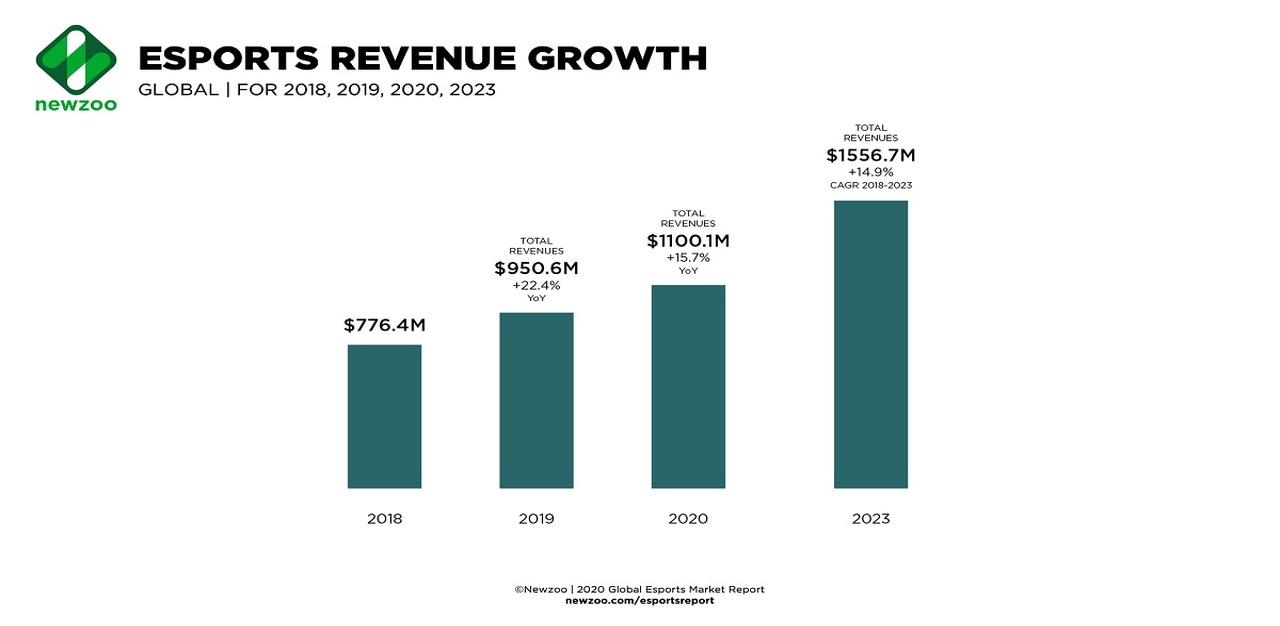

With all this financial growth occurring within the esports sphere, it stands to reason that the level of third-party investment in esports will increase accordingly. In 2019, the entire esports industry was worth approximately US$1 billion (S$1.45 billion). This figure is expected to increase to US$4.27 billion (S$5.75 billion) in 2027.

The decline of traditional media has also contributed to an increase in esports investment. Most esports viewers are within an age range spanning 18 to 35 – a demographic which has generally spurned traditional media in favour of social media. Since the bulk of esports content is consumed on social media, savvy esports investors can therefore capitalise on the younger generation’s presence on social media.

There are many different investment opportunities which exist within the esports world. Most first-time esports investors tend to invest in areas of esports with similarities to other traditional industries. These areas include esports media, advertising, and merchandise. Wealthier and more experienced investors, meanwhile, might choose to invest in companies which organise esports events or in esports teams.

Tran says, “The questions investors ask are where they can apply the most leverage (and get the most return), and also what a company’s investment horizon looks like. These are still the early years of the esports industry. We have yet to see a fraction of the financial potential of esports.”

How bright is the future?

Unlike what some might assume, the financial growth of esports appears to be sustainable. As esports continues to establish a presence in mainstream culture, public awareness and interest in esports can be expected to increase. In addition, it is already commonplace for professional players to broadcast live streams of their play on streaming platforms such as YouTube Gaming or Twitch, where viewers can leave comments as the action unfolds. This relatively close connection between professional players and viewers continues to drive the popularity and financial viability of esports on an upward path.

Although the esports scene of today is dominated by PC gaming, mobile gaming is also expected to further increase the profitability of esports in the future. Mobile gaming is characterised by relatively few barriers to entry, allowing for a greater level of accessibility. The growing mobile esports scene should prove to be a fertile ground for ample financial growth and opportunities.

One final factor which can be expected to further drive esports revenue is the ongoing abatement of the Covid-19 pandemic. During the height of the pandemic, many esports tournaments had to be postponed or cancelled outright. Those which went ahead either did so remotely or with either attendance restrictions or no in-person spectators at all. On this matter, Tran says, “As with other sports industries, live events were a big part of our esports program. (We) had to adapt to the new normal and find ways to engage with our fans, pro-teams, vendors, and sponsors through virtual offerings.”

As a result, revenue was depressed not only due to reduced ticket sales, but also due to a reduced media presence as well as a drop in merchandise sales at the venues. As crowds begin to return to esports tournaments, these accompanying revenue streams will also return and provide a much-needed financial boost for esports.

No matter what the future may hold for the world of esports, it cannot be denied that esports has truly transcended our computer or mobile phone screens, going from something which once appealed to a limited audience to a staple of the present-day gaming and social media experience.

It is for exactly this reason that esports can be expected to become even more lucrative in the coming years. For players, coaches, event staff, presenters, merchandise sellers, investors, and so many others, the opportunities to make money through esports involvement are almost limitless.

Join the conversations on TheHomeGround Asia’s Facebook and Instagram, and get the latest updates via Telegram.