Fill Me In

A study conducted by both iPrice Group and App Annie Intelligence found that the top three e-wallet apps in Singapore in terms of combined monthly active Apple and Android phone users as well as combined iOS and Google Play downloads (measured from Q4 2017 to Q3 2019) were Grab, DBS PayLah!, and Favepay (from highest to lowest).

However, Razer Pay had not been introduced back in 2017. Now, with the Razer Card in the pipeline, its complementary Razer Pay may just become a new heavyweight contender for the title of ‘top e-wallet app’ in Singapore.

Enter the Razer Card

The Razer Card is the brainchild of Visa and Razer Fintech, the financial technology subsidiary of Razer Inc. This comes after news of Razer Fintech leading a consortium to bid for a digital full banking licence issued by the Monetary Authority of Singapore broke at the start of this year — a move by the gaming hardware company’s fintech arm to try to establish Razer Youth Bank, the world’s first global youth bank.

Catering to youth and millennials

According to Lee Li Meng, the Chief Executive Officer of Razer Fintech, the Razer Card is “a unique prepaid solution” that provides the fintech subsidiary with “many opportunities” to cater to “the needs of consumers, particularly the youth and millennials”.

Of course, the sleek aesthetics of the card is the main attraction when it boils down to the younger generations, especially gamers.

LED lighting instead of RGB lighting

The Razer Card will use a green LED instead of the normal RGB lighting, thus giving off the warm green glow that is synonymous with Razer Inc. each time a payment is made.

Beta test for the Razer Card

The Razer Card Beta Program will start on 12 October 2020 (at 11.59pm) and end on 31 December 2020 (at 11.59pm) and is open exclusively to 1,337 users with registered Singaporean mobile phone numbers.

Eligibility

All participants must be 16 years old and above. However, if you happen to be below the age of 16, you can still sign up for the beta programme by presenting a letter of consent from your parents/legal guardian(s).

Virtual, Standard and Premium Cards

If you are selected to join the beta programme after signing up, you can then upgrade to get either the Standard Razer Card, which does not include the LED, or the Premium Card.

The Virtual Card will already be included in the e-wallet, Razer Pay, as the 16-digit Razer Card credentials.

Becoming a beta user

In order to participate in the programme and become a beta user, you must first register here with your personal particulars (application form is at the bottom of the webpage). Then, if you are selected to join the programme, you will receive a notification within 10 days.

Next, you will have to download the Razer Pay App via the Google Play Store/Apple App Store.

Once you do this, you will have to verify your identity via e-KYC ID (electronic Know Your Customer identification).

Lastly, you will have to activate either the Virtual Card or the Standard Razer Card.

Free gifts received upon opting for Razer Card(s)

Opting for and activating only the Virtual Razer Card will grant you a free Razer Cloth Mask while opting for both the Virtual Razer Card and the Standard Razer Card will grant you a free Razer Cloth Mask and a Standard Razer Card with the first year’s subscription fee waived.

Free coupon(s) for beta users who opt for Premium Cards

All beta users who opt for the Premium Cards will be given coupon(s) which they must use to pay for the first year’s subscription fee starting in January 2021. Each beta user is entitled to only one Premium Razer Card.

Tasks and Task Rewards

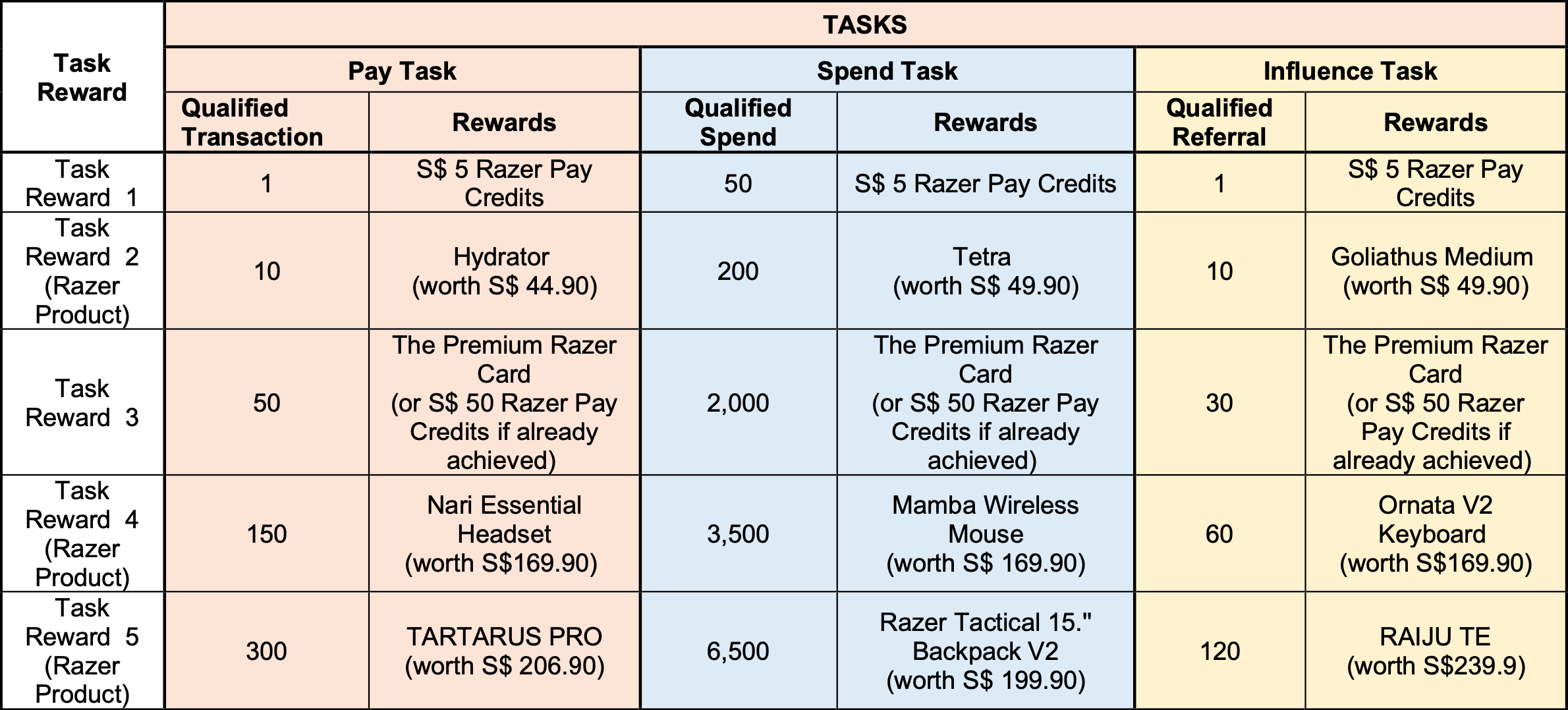

There are three kinds of tasks: Pay Task, Spend Task, and Influence Task. Beta users will be rewarded with gifts that increase in value with the users’ level of achievement (see table below for reference).

Ultimate Rewards and Meta Rewards

Beta users who complete all the Pay, Spend, and Influence Tasks will be eligible for a Mystery Reward that is worth S$749.90.

Meta Rewards, on the other hand, are given to the beta user who achieves the most for each Task category.

If two or more users are tied with one another in terms of the highest number of Qualified Transactions, Qualified Spend or Qualified Referrals, then the winner will be randomly selected from this group of people. The winner of each category will receive a Razer Blade 15 Laptop that is worth S$2,799.

Redeeming rewards

Beta users who attain milestones by completing Tasks will be issued redemption card numbers and security codes to redeem their rewards.

To redeem them, you must first go to the RazerStore to search for the products you have won.

Then, you must add the product to your shopping cart and check out with your Razer ID or as a guest.

Complete the checkout with your shipping and billing information, then select your shipping method and enter the redemption card number and security code in the Gift Card section.

However, beta users should be mindful of the fact that redemption card numbers will expire on 31 January 2021. Once this happens, users will not be entitled to any compensation in the form of a refund or credit from Razer Pay. Hence, it is important that all users redeem their rewards before 31 January 2021 to prevent any complications from arising.

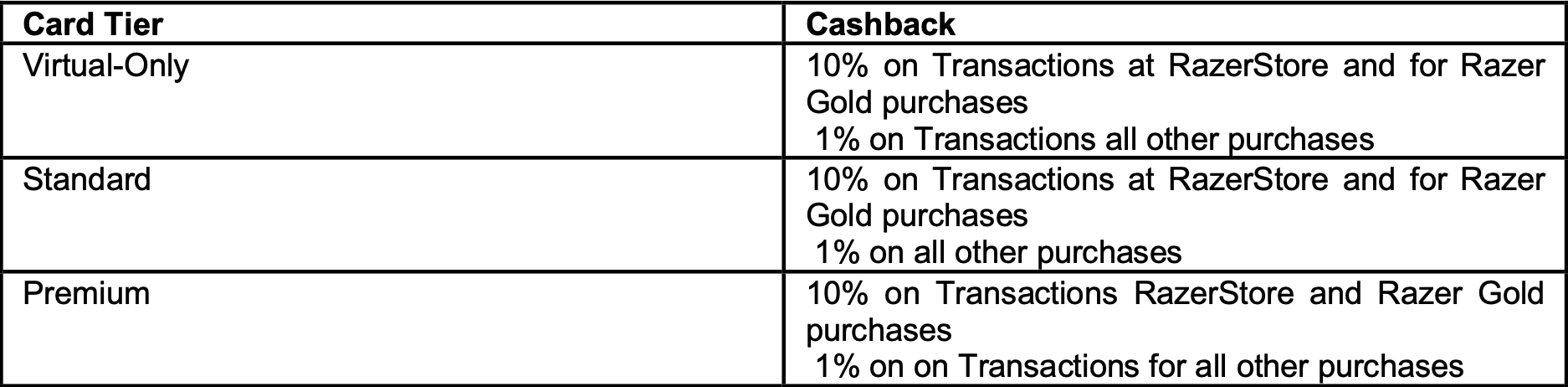

Razer Pay uses two-tier cashback system

Under the programme, users will get an upsized 10% cashback on RazerStore and Razer Gold purchases for all card types. Once the beta programme ends and the Razer Card is officially launched in January 2021 in Singapore, the cashback will revert to the normal 5%.

Furthermore, the Razer Card has no minimum spend and cashback limit.

The card also offers 1% cashback on purchases across all categories (except for RazerStore and Razer Gold purchases).

Apple Pay uses pyramid structure for cashback system

At the base (broadest applicability), Apple offers 1% cashback on all purchases. In the middle, it offers 2% cashback on all Apple Pay purchases made with Apple Card. And at the top, it offers 3% cashback on all Apple-related purchases at Apple retail stores, the App Store, iTunes, and some third-party partner stores.

Apple also offers 3% cashback on Apple Pay purchases made with Apple Card for some other select merchants. In the future, it plans to expand this 3% cashback to more merchants and apps.

A debit card that doubles as a prepaid one

The new Razer Card is a bi-functional card that combines the main functions of debit and prepaid cards. Apart from the standard function of deducting funds from an associated bank account, the card can also be topped up by unbanked users with funds, via Razer Pay, which can then be spent from.

Contactless payment technology

Cardholders will be able to tap and go when using public transport as well as buying meals at fast-service restaurants and movie tickets at cinemas.

Apple Pay has more contactless payment methods

Apple Pay has four contactless payment methods while Razer Pay only appears to have one so far. The four payment methods for Apple Pay are payment with Face ID, payment with Touch ID, payment with a different card from the default one and payment using a rewards card.

Face ID and Touch ID

Essentially, the first two methods are the same: unlock iPhone using either Face ID or Touch ID and position phone within a few centimetres of the contactless reader to make payment.

Payment with different card

The third one requires the user to tap on the default card (in Apple Pay app) when it appears and then choose another card. Following this, they will have to authenticate with Face ID, Touch ID or passcode before being allowed to make payment by placing the phone near the contactless reader.

Payment with rewards card

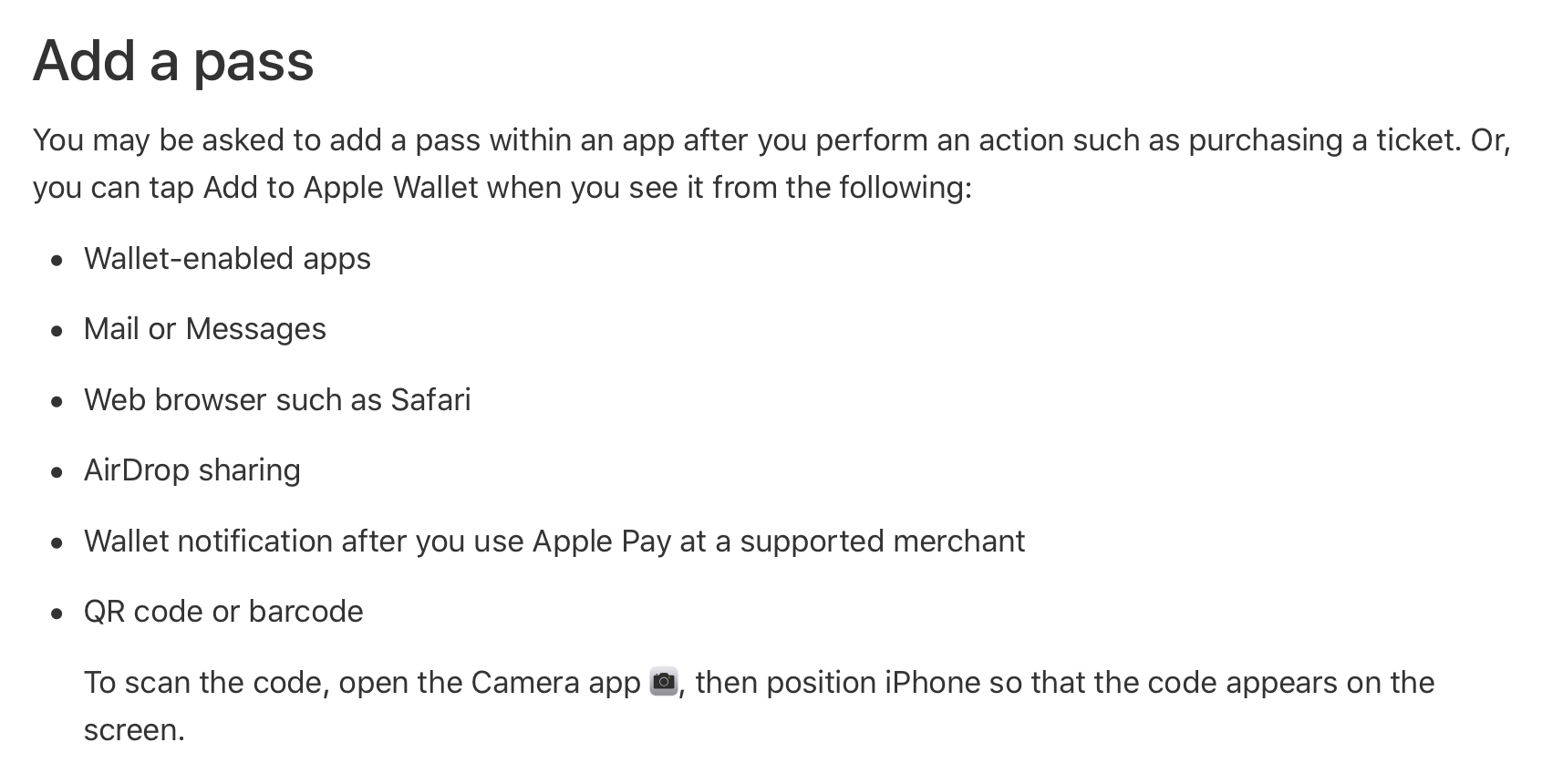

The fourth one is less straightforward. The user must first add the rewards card (pass) by tapping on ‘Add to Apple Wallet’ when it appears in any one of the following locations shown in the image below.

This ensures that the rewards card will be presented and applied upon bringing the iPhone near the contactless reader.

Once this is done, simply hold the iPhone near the contactless reader so that Apple Pay can automatically switch to your default payment card to make the payment. In some cases, these two steps will occur simultaneously while in others, the payment will only be made when the payment terminal or cashier asks for payment.

Pre-arming Apple Pay — will Razer Pay pick up on this?

A common problem faced by Apple Pay users is the time taken to prepare the Apple Pay app so that it is ready for payment, especially on public transport. Basically, the guide details a pre-arming method that ensures users are ready to make payments as soon as they reach the contactless reader/gantry via four (for newer iPhone models) or five (for older iPhone models) steps.

However, this pre-arming method is not practical and intuitive to new users who may still be familiarising themselves with launching the Apple Pay app from the lock screen. The same problem could be said for future Razer Pay users if the e-wallet were to be used for contactless payments.

The best solution would be to allow users to replace the preexisting camera app on the locked screen with an e-wallet app instead. However, since the camera app is a system app on both iOS and Android, this may not be possible unless users decide to jailbreak their iPhones or root their Android devices.

Eventually, both Apple and Razer will have to find ways to integrate their e-wallet apps into the lock screen which is essentially part of the smartphone’s in-built framework, in order to make e-wallet accessibility much greater as the global e-wallet audience surges YoY.

Visa merchants only

Since the Razer Card is effectively a Visa card, it can only be used to make payments at Visa merchants. Fortunately, there are more than 61 million Visa merchants globally.

Apple Pay allows both Mastercard and Visa

A difference between Apple Pay and Razer Pay is that the former allows both Mastercard and Visa credit and debit cards, while the latter allows only Razer Cards (Visa debit/prepaid).

Apple Card is a credit Mastercard

This is in direct contrast to the Razer Card. As Apple is partnering with Mastercard, the Apple Card can therefore only be used at Mastercard merchants.

Furthermore, it is a credit card optimised for Apple Pay that still functions like any ordinary credit card for all purchases.

Overseas expansion for Razer Card

Given that there are a large number of Visa merchants worldwide, all versions of the Razer Card will eventually be made available in other countries where Razer Pay is available.

However, users in Singapore will be the first to witness the local public release of the Razer Card in January 2021.

Overseas expansion for Apple Pay, but not yet for Apple Card

So far, Apple Pay has reached APAC countries like Singapore, Australia, Japan and New Zealand, as well as European ones like Germany, United Kingdom, Austria and Czech Republic.

However, the Apple Card has two main requirements which has prevented people from other countries from signing up:

- At least 18 years old

- A US citizen or a lawful US resident with a valid, physical US address that is not a P.O. Box

Apple CEO planning to eventually release Apple Card globally

As of late last year, Apple CEO, Tim Cook, confirmed that an international version of Apple Card would eventually be released.

He also cited reasons such as different countries each having their own rules and regulations relating to banking countries, and a problem arising when sending emails to invite users to apply when they are based outside of the US, for delaying the global release of the Apple Card.

Razer Card is app-centric

The Premium Razer Card is really just a promotional front for Razer Pay. In fact, take away the physical glowing card and what you have left is an e-wallet that lets you pay via a debit/prepaid card. After all, the app is what gives users access to card controls and allows them to make top-ups — you really only need the Virtual Razer Card that comes free of charge with the app. If you already own a debit Mastercard but not a Visa debit card, then sure, go ahead and take advantage of the 1% cashback on all purchases that comes with no strings attached (no minimum spend and cashback limit). However, it would really come in handy if you were making RazerStore and Razer Gold purchases regularly beforehand since cardholders (non-beta) are entitled to a sizeable 5% cashback on such transactions.

Apple Pay trumps Razer Pay

While both e-wallet apps aim to increase brand loyalty through strong cashback offerings, Apple Pay’s cashback system is more gradual and holistic than Razer Pay’s, which leaves nothing in the middle for consumers who are looking to strike a balance between in-store purchases and those across the board.

Furthermore, the Apple Pay allows users to add a wide variety of credit and debit cards to the Wallet, which in turn gives users more freedom to choose among cards when making different payments; Razer Pay is singular in its concept of e-wallet and prefers to create a monopolistic environment in which only the Visa debit/prepaid Razer Card exists. Yet, while the Apple Card exists to complement Apple Pay, this e-wallet app gives more room for other types of cards to be used under it.

Not everyone is willing to adopt a new credit or debit card for the sake of fully utilising an e-wallet app. Sometimes, we just want to forgo our physical wallets without incurring the burden of having to acquire a new card at the expense of our preexisting ones.

As for the Apple Card, we’ll have to wait for the international version to be released to see if it lives up to the hype surrounding it.

Join the conversations on THG’s Facebook and Instagram, and get the latest updates via Telegram.