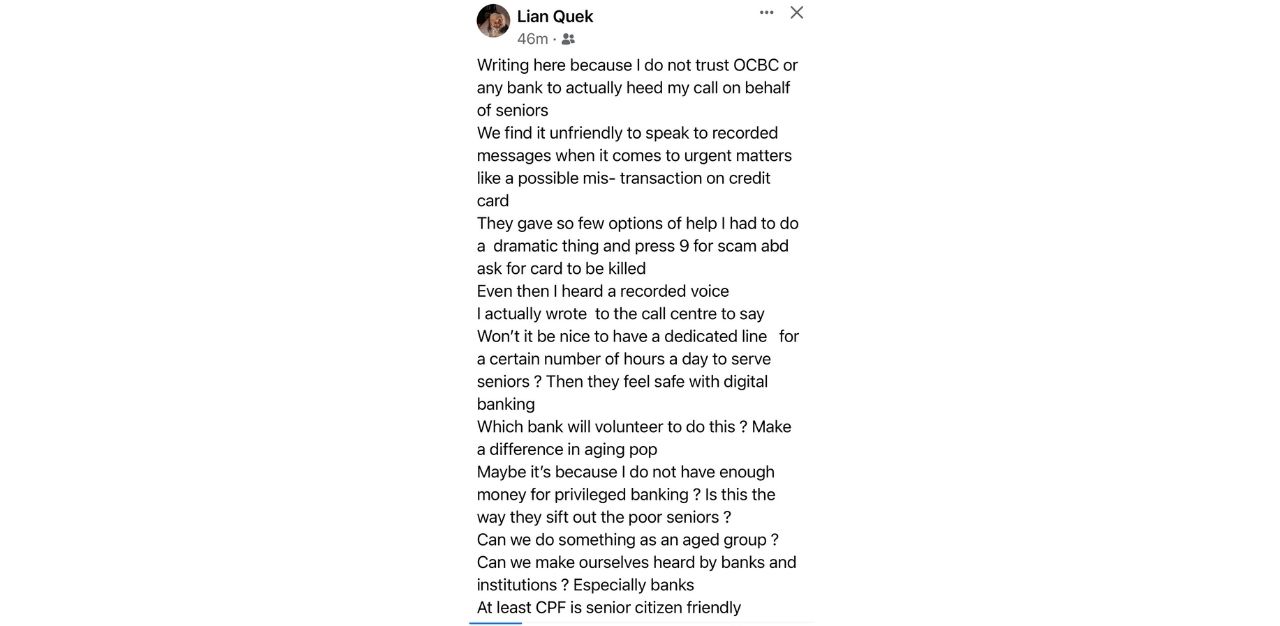

It was a mis-transaction on her credit card but teacher Lian Quek, 68, says she was “given the run-around” by her bank.

“We find it unfriendly to speak to recorded messages when it comes to urgent matters like a possible mis-transaction on the credit card and (the bank) had given me so few options of help that I had to do a dramatic thing – I pressed 9 for scam and asked for my card to be ‘killed’,” she wrote in a post on Facebook on 30 March, adding that even then, she was attended to by a recorded voice.

By “we”, she meant the elderly in Singapore.

“I am a teacher in this new age forced to do IT because of the Covid-19 pandemic and I find it frustrating. What about someone my age or older who is less exposed to technology? I believe this is how seniors become victims to scammers who sound human and kind,” she tells TheHomeGround Asia.

The bank Mrs Quek was referring to is one of the big three in Singapore: OCBC.

Moving financial services online may alienate elderly customers

Banks are no longer merely a place to park one’s savings. In today’s digital world, banks are increasingly offering an abundance of services, from cashless payments to insurance and investment schemes.

While the push for digitalisation and expansion of services is welcome, elderly bank customers like Mrs Quek feel like they are being alienated.

According to a 2019 survey conducted by Singapore’s Infocomm Media Development Authority (IMDA), residents aged 50 years and above had lower adoption rates in online shopping, internet fund transfer and mobile wallets, compared with respondents in the 15 to 49 age group. A “lack of skills” and “no need to use” were cited as the main reasons to stay away.

It posed a challenge to traditional banks as they invest in technology and prepare to fend off the looming threat from new digital-only banks. But the pandemic seemed to have given them some accelerated adoption in 2020 as seniors were among the fastest to switch to digital banking services in Singapore that year. This was likely the result of having been forced to stay indoors.

According to S&P Global Market Intelligence, almost a third of the more than 100,000 DBS Group Holdings customers who activated online spending services between February and April 2020 were above 50 years old.

The OCBC Bank Group reported a 20 per cent year-over-year increase in digital adoption among customers aged between 60 and 80, its fastest-growing segment for digital adoption. The United Overseas Bank (UOB) did not disclose the uptick in digital adoption attributed to the senior demographic.

In a letter to The Straits Times Forum last December, Mr Paul Chan Poh Hoi wrote that while he appreciated the logic behind digitalisation in the banking industry, it should not be at the expense of customer service.

“I am especially concerned that the relentless push to move basic services online, or mandate the use of mobile applications for simple transactions, will alienate elderly customers who are less proficient with technology. Of the around 640,000 Singapore residents aged 65 and above, many lack the requisite familiarity and trust in computer systems to fully embrace digital banking, myself included,” he wrote.

Mr Chan had been frustrated with labyrinthine user interfaces and overly elaborate security procedures that have turned simple banking tasks into protracted ordeals. Mrs Quek, too, has been annoyed but hers was dealing with phone banking and artificial intelligence.

“Try calling its 1-800 number. You will be asked to call out the issue and there are only three options. When I said ‘credit card transactions’, I got a voice reading out my transactions. That was when, in desperation, I pressed #9 for scams. The response is a recording. So, how can they respond to urgent calls to block cards? If that’s the way forward, the bank will get to field losses just like the recent incident,” she says.

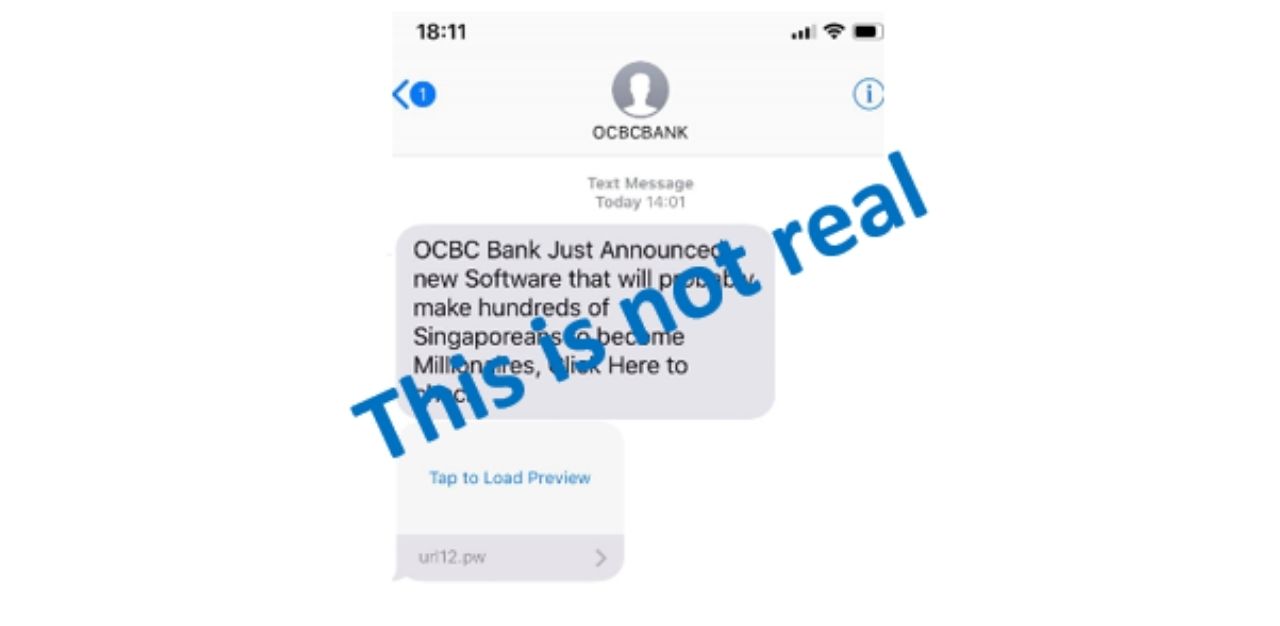

Mrs Quek was referring to the recent spate of phishing scams that caused OCBC to lose a total of S$13.7 million. It was reported by the media in January that the scam, which occurred between 23 and 30 December, affected 790 of its customers.

In a statement to the media in January, OCBC said about 80 per cent of the amount lost were during the year-end festive period and those who fell prey had provided their online banking log-in credentials and one-time PINs to phishing websites, enabling the scammers to take over their bank accounts and make fraudulent transactions. The calls made to the bank’s contact centre surged by over 40 per cent.

The Police have since arrested nine men, aged between 19 and 21, and four women, aged between 19 and 22, for their suspected involvement in the OCBC Bank phishing scams and seized an array of mobile devices, bank cards, SIM cards, cash amounting $2,760 and two Rolex watches, worth a total of $35,600.

Mrs Quek says she would rather “hold on for ages just to speak to a human on the other end, but I don’t even know if I will be attended to. So my alternative to waiting is to email”.

“I actually wrote to the call centre to say wouldn’t it be nice to have a dedicated line for a certain number of hours a day to serve seniors? That way, we will feel safe with digital banking and that would make a difference in a fast ageing population,” Mrs Quek says but she doubts if her initiative would make the banks “sit up, take notice and do something” because “we are just a group of elderly with no clout”.

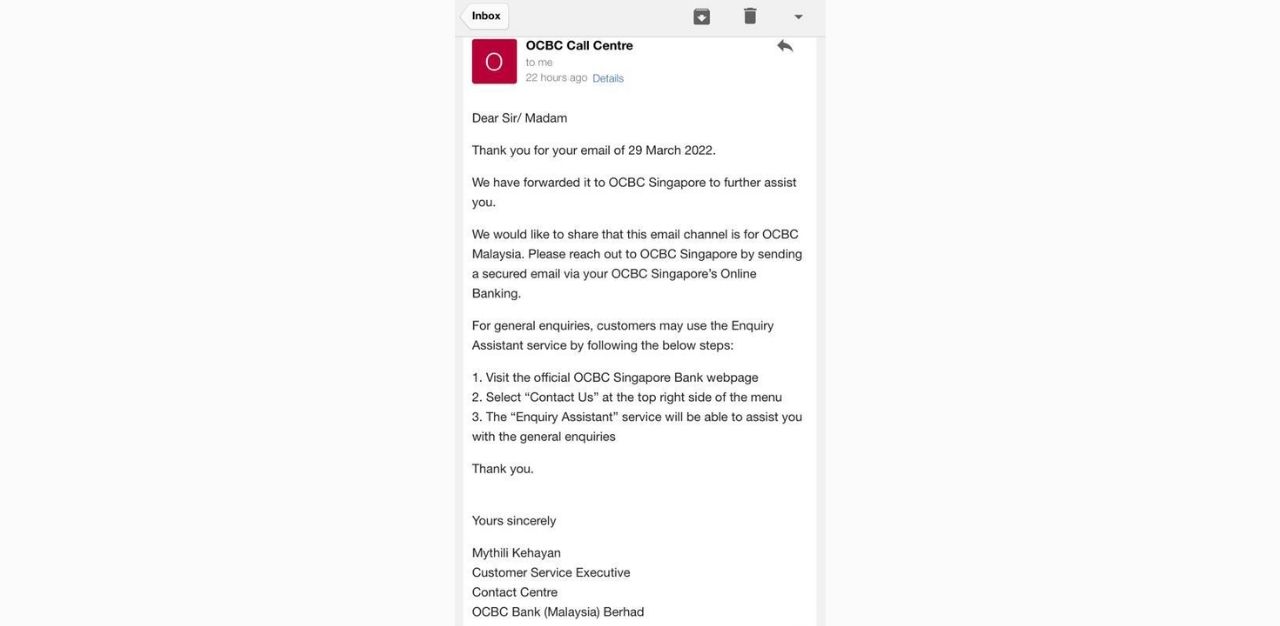

“Also, the email address provided was that for OCBC Malaysia and the branch there had to redirect it back to Singapore,” she adds.

How Japan’s financial institutions do it for the elderly

Mrs Quek says she often wonders how the aged in Japan cope with technology, especially when there are more than 36 million people aged 65 and older in the country.

Half of Japan’s US$17 trillion in personal financial assets is owned by them, a research by a gerontologist at Keio University in Tokyo Kohei Komamura found. The Financial Services Agency predicts that $2 trillion in personal financial assets or over 10 per cent of the nation’s total will be in the hands of people with dementia by 2030.

Financial fraud targeting elderly people is also a growing social problem in Japan, ranging from “ore-ore” phone scams, where a scammer calls up claiming to be a relative, to sophisticated, institutional-scale mis-selling of products.

Former president of Jonan Shinkin Bank Tsuyoshi Yoshiwara told Nikkei Asia in January 2020 that helping the local community is a mission of local banks and dealing with ageing issues has to be part of their responsibility.

“So which bank among the big three in Singapore will volunteer to make a difference in our fast-ageing population? How can we as a group of seniors make ourselves heard by banks and other financial institutions?” Mrs Quek asks.

Digital efforts continue with seniors in mind

OCBC Bank spokesman says, “We rolled out a ‘kill switch’ in February to enable customers to immediately freeze all their current and savings accounts in an emergency. This can be activated in the event of a scam using option ‘8’ via the Bank’s official contact number or at about 500 standalone OCBC Bank ATMs. An OCBC Bank customer service executive will contact the customer after the kill switch is activated to remove compromised bank account access or cards, and issue new ones.”

She says only a bank branch employee or customer service executive can deactivate the switch —and would only do so after receiving duly verified instructions from the customer. Once the kill switch is deactivated, the customer’s account will return to ‘normal’ and all settings prior to the account suspension – including GIRO arrangements and future-dated funds transfers — will be reinstated.

“The bank has also introduced a dedicated fraud hotline in January, which can be activated through option ‘9’ on its official contact number. A specially trained customer service executive can help customers freeze all bank accounts, guide them through the process of making a police report and follow up on their banking activities after informing the bank of the fraud,” adds the spokesman.

Both the kill switch and fraud hotline are in addition to the enhanced anti-scam measures that the Bank has implemented, in line with the industry’s efforts announced on 19 January 2022 by The Association of Banks in Singapore and the Monetary Authority of Singapore to bolster the security of digital banking.

OCBC says the most common queries among elderly customers calling its contact centre are about balance transactions and waiver requests and it has been continuing to amp up education efforts to help the elderly embrace digital banking.

“For example, our digital ambassadors and personal financial consultants actively work with seniors who walk into a branch on how to use our various digital tools. We have created digital guides and leveraged social media to help customers with their digital adoption. To ensure ease for our Chinese-speaking elderly customers, we have also enabled the Chinese language option on our mobile banking app,” its spokesman says.

With the Covid-19 pandemic accelerating digital adoption among customers, this growth is most significant among seniors aged 65 and above. The number of seniors using digital has increased 40 per cent from January 2021 to January this year

“In tandem with a shift in customer behaviour towards digital banking, our platforms are now able to handle 95 per cent of all financial transactions. At the same time, our new-generation ATMs can now perform close to 80 per cent of all over-the-counter services that customers typically come to the branch to do. These measures have helped many of our elderly customers move to digital platforms, because they can easily manage their cash, access wealth management products, and apply for bank accounts, credit cards, home loans and personal loans on our OCBC Digital mobile banking app or via Internet banking — without coming into the branches,” she says, adding that more seniors are purchasing digital wealth products such as digital bancassurance products, unit trusts, gold and blue–chip stocks, “with the number of customers above 65 years old who invest digitally growing four times from January 2021 to January 2022”.

A spokesperson from rival bank DBS tells TheHomeGround Asia that DBS has been supporting seniors through its range of initiatives, such as subsidised banking services, and in their transition to digital banking. It has engaged more than 5,700 seniors through over 120 face-to-face and virtual ePayments workshops last year.

As customers’ safety remains top priority at the bank, DBS has secure technology and protocols to ensure its customers’ information and money are safe, whenever they bank online. An example is its multi-factor authentication when customers perform online transactions.

Its spokesperson says there are dedicated customer assistance teams to deal with fraud cases and whenever customers call the bank’s dedicated anti-fraud hotline, it “will immediately freeze or suspend access to their accounts, cards and/or e-wallets to prevent further fund outflows”.

“Those who go to the branches to seek help will be attended to immediately – without needing to queue – by the branch service manager, who will help to prevent further fund outflows. Senior customers who require emergency assistance due to suspected scam or fraud, or significant monetary loss, will be helped by the customer service officers on its round the clock Lost Card & Fraud Reporting hotline,” she adds.

Despite the safeguards, senior bank customers wonder why the Central Provident Fund (CPF) Board is able to be “senior citizen friendly” and not the banks.

“CPF has scaffolded navigation and is properly guided that I am able to navigate and get to human voice to clarify the issues I had. For instance, when I wanted to understand what to do with my retirement account, I could speak to someone who has my data on hand and explain options to me. I feel that the banks should take a page from the CPF book,” Mrs Quek says. “Honour us by helping to kill our IT dinosaurs and stop resurrecting them with new stuff (for us) to learn. Not everyone has a PA (personal assistant) to call on for help.”

Join the conversations on TheHomeGround Asia’s Facebook and Instagram, and get the latest updates via Telegram.